Loading

Get Irs 1040 - Schedule 2 (sp) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

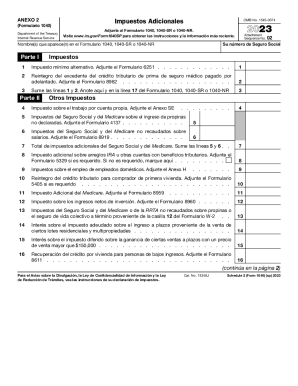

How to fill out the IRS 1040 - Schedule 2 (SP) online

Filling out the IRS 1040 - Schedule 2 (SP) is an important step in your tax preparation process. This guide provides clear instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the IRS 1040 - Schedule 2 (SP) online.

- Press the ‘Get Form’ button to access the IRS 1040 - Schedule 2 (SP) and open it in your preferred online editor.

- Begin by entering your Social Security number in the designated field at the top of the form. This number is crucial for identification purposes.

- Next, input your name or the names that appear on Form 1040, 1040-SR, or 1040-NR. Ensure this information is accurate to avoid any discrepancies.

- In Part I, report any alternative minimum tax owed. If applicable, attach Form 6251 and enter the amount on line 1.

- Proceed to line 2 and report any repayment of the excess premium tax credit from your advance payment. This requires attaching Form 8962.

- Add the amounts from lines 1 and 2 together, and write the total on line 3. This figure should also be noted on line 17 of your Form 1040, 1040-SR, or 1040-NR.

- In Part II, you will detail other taxes. Begin with line 4 by reporting any self-employment tax. Attach Schedule SE if this applies.

- Continue by filling in any unreported Social Security and Medicare taxes from tips or wages. Attach Form 4137 or Form 8919 as needed on lines 5 and 6.

- For line 7, sum the amounts from lines 5 and 6. This total will represent the additional Social Security and Medicare taxes owed.

- Complete the remaining lines in Part II as applicable, ensuring to attach the necessary forms indicated next to each item.

- Calculate the total additional taxes by adding the amounts in lines 17a through 17z and enter this total on line 18.

- Finally, complete line 21 by summing lines 4, 7 through 16, and 18. This value reflects your net tax liability. Write it on line 23 of your Form 1040 or 1040-SR, or in line 23b of Form 1040-NR.

- Once you have completed all the fields, you can save the changes, download the completed form, print it for your records, or share it as needed.

Take the first step and start filling out your IRS 1040 - Schedule 2 (SP) online today.

Related links form

Schedule 2: Supporting documentation for tax form 1040 if box 11b is checked. This Schedule is used to report additional taxes owed such as the alternative minimum tax, self-employment tax, or household employment taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.