Loading

Get Of Annuity Payments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the of annuity payments online

This guide provides a comprehensive overview on how to accurately complete the of annuity payments form online. It aims to assist users in establishing or modifying direct deposit instructions for their annuity contract, ensuring a seamless transition of funds to their preferred bank account.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

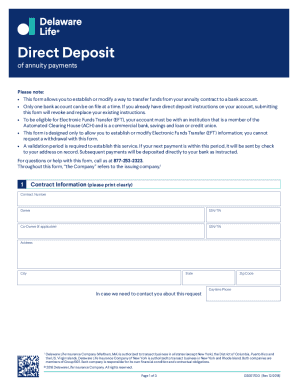

- Fill in the contract information section clearly. Include your contract number, owner’s name, social security number (SSN) or Tax Identification Number (TIN), and co-owner information if applicable. Make sure to provide a current address, including city, state, and zip code, along with a daytime phone number for contact purposes.

- In the bank account information section, select whether you want to deposit funds into a checking or savings account. Provide the required bank name, account name(s), account number, and the nine-digit routing number. Ensure that the bank address and contact number are also included.

- Attach a voided check for a checking account, or a voided check or a signed letter from your bank for a savings account. Ensure that all submitted documents adhere to the outlined requirements.

- In the signature section, all owners must sign the form. If signing as a fiduciary, include your relationship to the owner and attach any necessary documentation. Provide the date and ensure that a signature guarantee stamp is included if needed.

- Review all provided information for accuracy to avoid any processing issues. Once confirmed, you can choose to save your changes, download the completed form, print it, or share it as necessary.

Complete your direct deposit instructions online today to ensure timely payments directly into your bank account.

In addition to life expectancy influences your monthly payment will also depend upon the insurance company's expected investment returns on your money. If the insurer can expect to receive a 7 percent return on its $50,000, the monthly payout would rise to $449.96.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.