Loading

Get New York Form It-225 (new York State Modifications)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the New York Form IT-225 (New York State Modifications) online

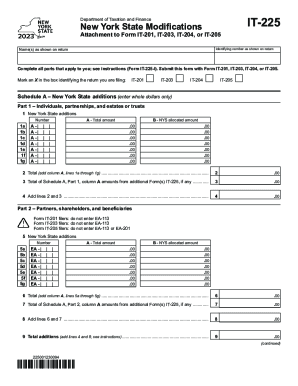

New York Form IT-225 is an essential document for individuals, partnerships, and estates or trusts who need to report modifications to their New York State tax return. This guide provides you with clear, step-by-step instructions on how to complete the form online, ensuring a smooth filing process.

Follow the steps to complete the New York Form IT-225 online.

- Press the ‘Get Form’ button to access the form and open it in the online editor.

- Fill in your name(s) as they appear on your tax return in the designated field.

- Enter your identifying number as displayed on your tax return, ensuring accuracy.

- Identify the specific return you are filing by marking an X in the appropriate box for IT-201, IT-203, IT-204, or IT-205.

- Proceed to Schedule A, where you will report New York State additions. Enter whole dollar amounts in the provided fields (1a through 1g) for any applicable additions, marking total amounts clearly.

- Calculate the total for Schedule A, Part 1, and enter it in the designated line after summing up your entries from column A.

- If applicable, add any additional amounts from other Form(s) IT-225 to the total from Schedule A, Part 1, referencing line 3 to complete this section.

- Continue to Schedule B to report any New York State subtractions. Similar to Schedule A, fill out the fields (10a through 10g) for any deductions in whole dollar amounts.

- Sum the totals for Schedule B and follow the same process as in Schedule A to finalize your numbers.

- Review all entries for accuracy and completeness before finalizing your form.

- Once satisfied with your entries, save changes, and proceed to download, print, or share the form as needed.

Start filling out your New York Form IT-225 online today for a seamless tax filing experience!

Beginning in 2022, the subtraction modification will be increased from 5% to 15%, and it will be available to: (a) sole proprietors with one or more employees and less than $250,000 of net business income or net farm income; (b) owners of New York S corporations and tax-partnerships with one or more employees and net ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.