Get Irs 990 - Schedule H 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule H online

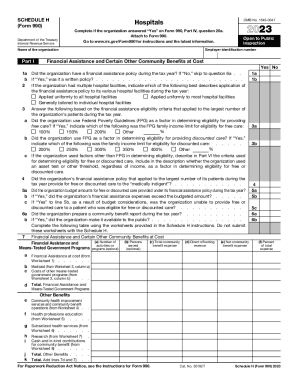

This guide provides a clear and comprehensive approach to filling out the IRS 990 - Schedule H online. Designed for healthcare organizations, this form captures vital information related to financial assistance and community benefits, ensuring compliance with tax regulations.

Follow the steps to complete the IRS 990 - Schedule H.

- Press the ‘Get Form’ button to access the IRS 990 - Schedule H document and open it in your online editor.

- Enter the name of your organization and employer identification number (EIN) at the top of the form.

- Complete Part I by responding to the questions regarding your financial assistance policy. Indicate whether you had a financial assistance policy during the tax year and whether it was written.

- In Part II, report any community building activities your organization conducted during the tax year. Fill in the number of activities and associated expenses.

- In Part III, address the section on bad debt, Medicare, and collection practices. Provide required figures and explanations as instructed.

- Fill in Part V with detailed information about each hospital facility operated by your organization, including community health needs assessments and financial assistance policies.

- Utilize the space provided in Part VI to include any needed supplemental information, ensuring all required descriptions and community health evaluations are detailed.

- Once all sections are complete, review your entries for accuracy. Save your changes, and then download or print the completed form for your records or submission.

Start filling out the IRS 990 - Schedule H online today to ensure compliance with tax requirements.

Use Schedule H (Form 1040) to report household employment taxes if you paid cash wages to a household employee and the wages were subject to social security, Medicare, or FUTA taxes, or if you withheld federal income tax. About Schedule H (Form 1040), Household Employment Taxes - IRS irs.gov https://.irs.gov › forms-pubs › about-schedule-h-for... irs.gov https://.irs.gov › forms-pubs › about-schedule-h-for...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.