Loading

Get Irs 1041 - Schedule I 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule I online

This guide provides a clear and supportive overview of how to complete the IRS 1041 - Schedule I online. It will walk you through each section and field, ensuring that you have the necessary information to fill out the form accurately and confidently.

Follow the steps to complete Schedule I effectively.

- Click ‘Get Form’ button to obtain the IRS 1041 - Schedule I form and open it in your preferred editor.

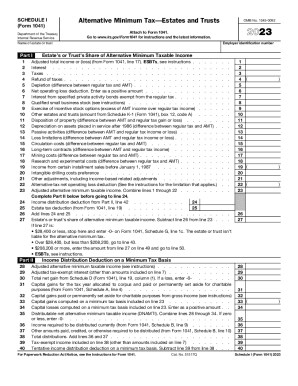

- Begin with Part I by entering the employer identification number in the designated field. Ensure that this number is accurate and aligns with the estate or trust's records.

- Fill in lines 1 to 23 with detailed amounts related to various types of income and deductions, such as adjusted total income, interest income, and other specified areas. Be precise with each figure and refer to prior tax documents for correct values.

- Proceed to compute the adjusted alternative minimum taxable income by combining the relevant amounts from lines 1 through 22, noting any specific instructions for calculating each item.

- Continue with your calculations by completing Part II and reporting the income distribution deduction based on alternative minimum tax criteria. Reference prior calculations from Form 1041 as needed.

- In Part III, enter the exemption amount and subtract as indicated to determine the alternative minimum tax owed. Pay close attention to the thresholds provided to ensure proper calculation.

- For Part IV, complete computations related to capital gains rates as applicable, ensuring all figures align correctly with those on Schedule D if completed.

- Once all sections are filled out, review the form thoroughly for accuracy. Make any necessary adjustments or corrections.

- Finally, save your changes, download a copy for your records, and print or share the completed IRS 1041 - Schedule I form as required.

Complete your IRS forms online today for a smoother filing experience.

Use Form 1041-A to report the charitable information required by section 6034 and the related regulations. The trustee must file Form 1041-A for a trust that claims a charitable or other deduction under section 642(c) unless an exception applies. Form 1041-A - IRS irs.gov https://.irs.gov › pub › irs-access › f1041a_accessible irs.gov https://.irs.gov › pub › irs-access › f1041a_accessible

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.