Loading

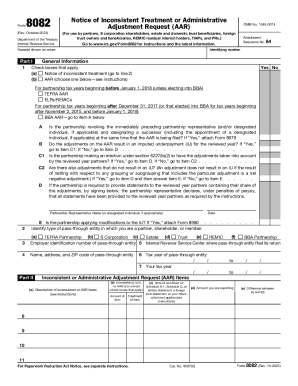

Get Form 8082 (rev. October 2023). Notice Of Inconsistent Treatment Or Administrative Adjustment

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 8082 (Rev. October 2023). Notice Of Inconsistent Treatment Or Administrative Adjustment online

Filling out the Form 8082 is essential for individuals and entities seeking to address inconsistent treatment or request administrative adjustments. This guide provides clear, step-by-step instructions tailored to users with varying levels of experience in digital document management.

Follow the steps to complete the Form 8082 efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor for review and completion.

- Begin by entering the identifying number and name(s) as shown on the tax return at the top of the form.

- In Part I, indicate whether you are submitting a notice of inconsistent treatment or an administrative adjustment request by checking the appropriate boxes.

- If filing for an administrative adjustment, select the applicable type (TEFRA AAR, ELPs/REMICs, BBA AAR) based on the specific requirements outlined in the instructions.

- Address the subsequent questions related to the partnership's representative designation and any adjustments affecting the reviewed year, ensuring to attach additional forms if requested.

- In Part II, provide descriptions for the inconsistent treatment or AAR items including necessary financial amounts and the treatment specifics in the corresponding columns.

- Complete the explanations section in Part II, where you will show how the imputed underpayment was calculated and any modifications made.

- Finally, review all entries for accuracy before signing the form in the representative declaration section and providing the date.

- After finishing the form, you can save any changes, download a copy for your records, print it, or share it as needed.

Complete your documents online today for a smoother filing experience.

Related links form

Notice of inconsistent treatment. Use Form 8082 to notify the IRS of any inconsistency between your tax treatment of an item and the way the pass-through entity treated and reported the same item on its return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.