Loading

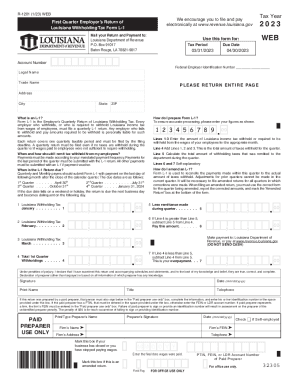

Get 2023 Web - Louisiana Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 WEB - Louisiana Department Of Revenue online

Filing your taxes can be a straightforward process when you're equipped with the right information. This guide provides a clear, step-by-step overview of how to complete the 2023 WEB - Louisiana Department Of Revenue form online, ensuring that you navigate each section with confidence.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Federal Employer Identification Number (EIN) in the designated field. This number is essential for identifying your business.

- Provide the legal name and trade name of your business in the respective fields, ensuring accuracy to avoid any processing delays.

- Fill in your address, including city, state, and ZIP code, as this information is crucial for correspondence.

- Indicate the tax period for which you are filing; for example, the first quarter would be for the dates ending on 03/31/2023.

- Enter the amount of Louisiana income tax withheld for January, February, and March in Lines 1, 2, and 3 respectively.

- Calculate the total by summing Lines 1, 2, and 3, and enter the result on Line 4.

- On Line 5, report the total amount of withholding taxes that you have remitted to the department during the quarter.

- If applicable, fill in Lines 6 and 7 as instructed to determine any amount owed or overpayment.

- Complete the declaration section by signing and dating the form to verify the accuracy of the information submitted.

- If a paid preparer assisted you, ensure they complete their section, including their identification number, and sign the form.

- Before submitting, review all entries for accuracy. Once satisfied, you may save changes, download, or print the form for your records.

Complete your documents online today to ensure timely and accurate submissions.

Louisiana Income Tax Brackets for 2023 Here's how it breaks down for this individual: The first $12,500 of income is taxed at 1.85% ($231) The next portion of income from $12,500 to $50,000 is taxed at 3.50% ($1,313) Finally, the remaining income from $50,000 to $350,000 is taxed at 4.25% ($12,750)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.