Loading

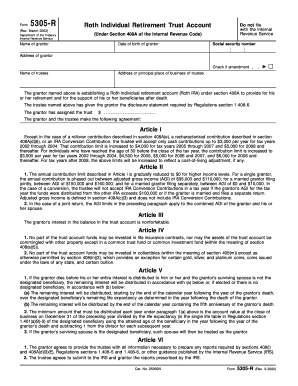

Get Form 5305-r (rev. 03-2002) - Internal Revenue Service

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5305-R (Rev. 03-2002) - Internal Revenue Service online

Filling out Form 5305-R is an essential step for establishing a Roth Individual Retirement Account. This guide provides clear, step-by-step instructions tailored to users of all experience levels to ensure a smooth online completion of the form.

Follow the steps to successfully complete your form online.

- Use the 'Get Form' button to access and view the form in your preferred online platform. Ensure you have a secure connection while accessing the document.

- Enter the name of the grantor in the designated field. This refers to the individual establishing the Roth IRA. Ensure the spelling is correct for accurate record keeping.

- Fill in the date of birth of the grantor. This date is essential for identification and eligibility verification.

- Input the social security number of the grantor in the specified section. This information is crucial for IRS records and tax purposes.

- Provide the address of the grantor. Ensure that this is the current address, as it may be used for correspondence regarding the account.

- If applicable, check the box indicating an amendment to the account. This is only necessary if changes are being made to an existing agreement.

- Enter the name of the trustee in the relevant field. The trustee is responsible for managing the account.

- Fill in the address or principal place of business of the trustee. This ensures proper communication regarding the account.

- Summarize the assigned amount into the trust account if applicable. This amount represents the initial contribution or transfer.

- Review Articles I to IX, which outline the terms of the agreement. Ensure you understand the contribution limits and requirements.

Complete your document and establish your Roth IRA efficiently by filling out the necessary forms online.

An Individual Retirement Account is opened, funded and managed by an individual, independent of any employer involvement. Individual Retirement Accounts (IRAs) - Guardian Life guardianlife.com https://.guardianlife.com › ira guardianlife.com https://.guardianlife.com › ira

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.