Get Irs 1040 Schedule 8812 Instructions 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule 8812 Instructions online

This guide provides a clear step-by-step approach to completing the IRS 1040 Schedule 8812 Instructions online. Follow these instructions to accurately file for child tax credits and other related dependents.

Follow the steps to complete the IRS 1040 Schedule 8812 Instructions.

- Use the 'Get Form' button to acquire the Schedule 8812 form and open it in your preferred digital document management tool.

- Begin by reviewing the general instructions provided on the form. Ensure that you understand the eligibility criteria for claiming the child tax credit (CTC) and the credit for other dependents (ODC).

- In Part I of the form, indicate the number of qualifying children under 17 at the end of the tax year by checking the relevant boxes in column (4) of the Dependents section, and enter the total on line 4.

- If you are claiming the ODC, check the appropriate box in column (4) for those dependents and enter the total on line 6.

- Proceed to complete Part II-A to determine the additional child tax credit (ACTC) amount. Fill in lines as directed, including your modified adjusted gross income (line 18).

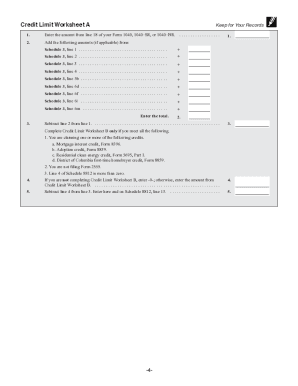

- If applicable, complete the Credit Limit Worksheets A and B as directed in the instructions to calculate any additional credit limits based on your financial situation.

- Review all entries made on the form for accuracy and completeness. Make sure you have documentation ready to support your claims, especially the required taxpayer identification numbers (TINs).

- Once all sections are completed, you can save your changes, download the completed form, print it, or share it as necessary.

Complete your IRS 1040 Schedule 8812 Instructions online to ensure you maximize your eligible credits.

If you are a single parent, you may be able to claim the amount for an eligible dependent. Regardless of how many children you have, you can claim this amount for one child only. You can claim the full amount of the year of birth. If you have shared custody, only one parent can claim the amount. Family Tax Deductions: What Can I Claim? | 2022 TurboTax® Canada ... intuit.ca https://turbotax.intuit.ca › tips › family-tax-deductions-w... intuit.ca https://turbotax.intuit.ca › tips › family-tax-deductions-w...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.