Get Wa Dor Multi-purpose Combined Excise Tax Return 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA DoR Multi-Purpose Combined Excise Tax Return online

Filing the Washington State Department of Revenue Multi-Purpose Combined Excise Tax Return online is a straightforward process designed to streamline tax reporting for businesses. This guide provides a step-by-step overview to assist users in accurately completing the form and ensuring compliance with state regulations.

Follow the steps to effectively complete your Multi-Purpose Combined Excise Tax Return online.

- Press the ‘Get Form’ button to retrieve the Multi-Purpose Combined Excise Tax Return and open it in your preferred digital editor.

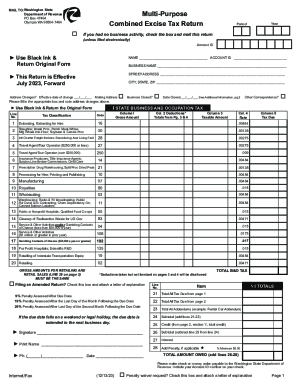

- Begin by entering the year and the period of the tax return at the top of the form.

- Fill in your Account ID, followed by your name and business name in the designated fields.

- Complete the street address, city, state, and ZIP code for your business location. If there are any mailing address changes, provide the effective date of the change.

- Select the appropriate tax classification and indicate if the business is closed by checking the corresponding box and providing the date closed, if applicable.

- For the Business and Occupation tax section, carefully list your gross amounts, deductions, and applicable rates for the various classifications provided, ensuring each taxable amount is calculated correctly.

- Proceed to fill out the State Sales and Use Tax section, entering necessary details such as gross amounts and deductions for retail sales and use tax.

- After entering all relevant information in the Local City and/or County Sales and Use Tax section, ensure that the total taxable amounts match the values reported in previous sections.

- In the Other Taxes section, detail any additional taxes your business might be liable for, using the designated fields for each classification.

- Complete the Credits section by listing any tax credits you are claiming and ensure all calculations are accurate.

- Before finalizing, review all sections for completeness and accuracy, including signature and contact information.

- Once all entries are verified, save your changes, then download, print, or share the completed form for submission.

Take a moment to complete your registry for the WA DoR Multi-Purpose Combined Excise Tax Return online and ensure your compliance.

On-Line Payments Pay online using one of the following options: Credit Card: Pay using our merchant services provider online or by phone at 833-440-3332. Debit and credit card (MasterCard, Visa, American Express, and Discover) and electronic check (eCheck) transactions are securely processed for a fee.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.