Get Form Ca-5 Claim For Compensaion By Widow ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

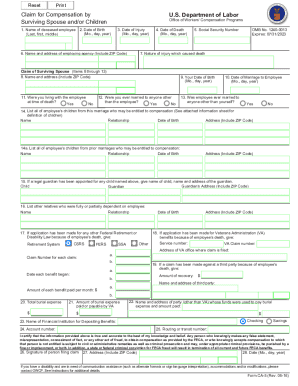

How to fill out the Form CA-5 Claim for Compensation by Surviving Spouse and/or Children online

Filling out the Form CA-5 Claim for Compensation by Surviving Spouse and/or Children online can seem complex, but this guide will walk you through each section to ensure you submit a complete and accurate claim. Follow these instructions closely to help facilitate the claims process.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and access it in your preferred document editor.

- Begin with Section 1, where you will enter the name of the deceased employee. Ensure the spelling is accurate to avoid delays.

- Provide the date of birth of the deceased in Section 2, following the format (month, day, year).

- In Section 3, enter the date of injury in the same format as before.

- Fill out Section 4 with the date of death, adhering to the previously mentioned format.

- Complete Section 5 by entering the Social Security number of the deceased employee.

- In Section 6, provide the name and address of the employing agency, ensuring to include the ZIP code.

- Describe the nature of the injury which caused death in Section 7; this should clearly explain the incident.

- Proceed to the claim of the surviving spouse in Sections 8 to 13. Enter your name and address in Section 8, and answer the questions about your relationship with the deceased employee in Sections 11, 12, and 13, choosing Yes or No where applicable.

- List all of the employee's children from both the marriage and any prior marriages in Sections 14 and 14a, providing necessary details such as names, relationships, and dates of birth.

- If applicable, include the name of any legal guardian for the children in Section 15.

- Document any other relatives who were dependent on the employee in Section 16.

- If claims have been made for other benefits, complete Sections 17 through 19 with the relevant information.

- Fill in Sections 20 to 25 regarding burial expenses and banking information for direct deposits.

- Certify the accuracy of the information provided by signing in Section 26, also entering your address and the date of signing.

- Review the form for completeness and accuracy before saving changes, downloading, printing, or sharing the document.

Start your claim process today by completing the Form CA-5 online.

A surviving spouse who has eligible children is entitled to compensation at the rate of 45% of the deceased employee's salary. If an eligible spouse has children, an additional 15% is payable for each child, to a maximum of 75% of the salary. Filing for Death Benefits - U.S. Department of Labor dol.gov https://.dol.gov › files › OWCP › dfec › icstraining dol.gov https://.dol.gov › files › OWCP › dfec › icstraining

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.