Loading

Get Form 941-v Payment Voucher For Paying Balance Due ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 941-V Payment Voucher for Paying Balance Due online

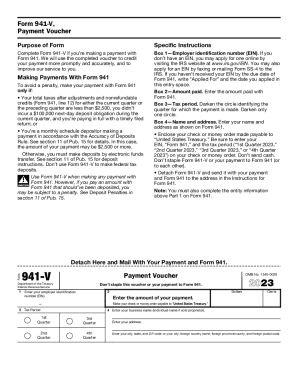

Filling out the Form 941-V Payment Voucher is an essential process for individuals making payments with Form 941. This guide will provide clear, step-by-step instructions on how to complete the form accurately online to ensure timely processing of your payment.

Follow the steps to successfully complete the Form 941-V Payment Voucher

- Press the ‘Get Form’ button to access the payment voucher form and open it in your preferred editing tool.

- In Box 1, enter your employer identification number (EIN). If you do not have one, you can apply for it through the IRS website or by submitting Form SS-4 to the IRS.

- In Box 2, indicate the total amount you are paying with Form 941.

- In Box 3, darken the circle that corresponds to the tax period for which the payment is being made. Ensure that you only select one circle.

- In Box 4, input your name and address as displayed on Form 941.

- Attach your check or money order, made payable to 'United States Treasury,' and be sure to include your EIN, 'Form 941,' and the tax period on your payment. Avoid sending cash or stapling the payment to the voucher.

- After completing the form, detach Form 941-V from the document and send it along with Form 941 to the address specified in the instructions for Form 941.

- Once you have made all necessary entries, save any changes, and consider downloading a copy for your records before sharing or printing the final form.

Ensure your payments are processed accurately by filling out and submitting your Form 941-V Payment Voucher online today.

Form 1040-V is a statement you send with your check or money order for any balance due on the “Amount you owe” line of your Form 1040 or 1040-NR.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.