Loading

Get Utah State Income Tax 2022-2023 Form - Fill Out And Sign ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Utah State Income Tax 2022-2023 Form - Fill Out And Sign ... online

Filling out the Utah State Income Tax form can be a straightforward process when you follow the right steps. This guide provides clear, step-by-step instructions to help you easily complete the form online.

Follow the steps to fill out the form accurately.

- Click ‘Get Form’ button to access the form and open it in your online editor.

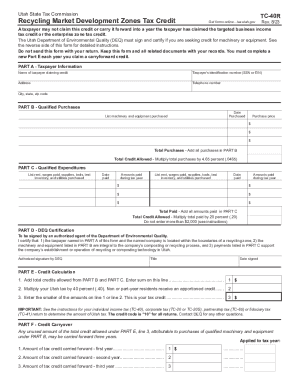

- In Part A, enter the taxpayer information, including the name of the taxpayer claiming the credit, their identification number (SSN or EIN), address details, and contact number.

- Proceed to Part B to list any machinery and equipment purchased as qualified purchases. Record the purchase date and purchase price, ensuring to total all purchases at the end of this section.

- In Part C, document qualified expenditures such as rent, wages paid, and utilities. Enter the date amounts were paid during the tax year and calculate the total amount paid.

- For each of the totals calculated in Parts B and C, multiply by the respective percentages to determine the total credits allowed, ensuring not to exceed the maximum credit limit where applicable.

- Complete Part D by obtaining an authorized signature from the Department of Environmental Quality (DEQ) to certify your claim.

- In Part E, add the total credits from Parts B and C. Then calculate 40 percent of your Utah tax and determine the smaller amount as your tax credit.

- If you have any unused credits, complete Part F indicating amounts carried forward for up to three years.

- After filling out all sections, be sure to save your work. You can download, print, or share the completed form as needed.

Start completing your Utah State Income Tax form online today for a hassle-free filing experience.

You must file a Utah TC-40 return if you: are a Utah resident or part-year resident who must file a federal return, are a nonresident or part-year resident with income from Utah sources who must file a federal return, or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.