Loading

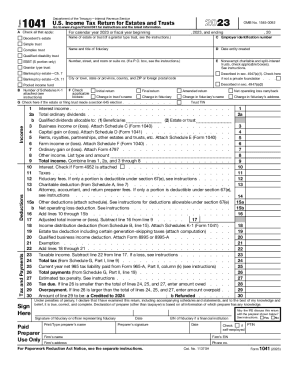

Get 2023 Form 1041

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form 1041 online

This guide provides a clear, step-by-step walkthrough for completing the 2023 Form 1041, the U.S. Income Tax Return for Estates and Trusts. Designed for users with varying levels of experience, this resource aims to make the process of filing this form online straightforward and accessible.

Follow the steps to successfully complete your online form.

- Press the ‘Get Form’ button to access the form and launch it in the editor.

- Check the applicable box to indicate whether the filing is for a decedent’s estate or another type of trust. Fill in the name of the estate or trust, and include the employer identification number (EIN) as required.

- Complete the 'Name and title of fiduciary' field and the 'Date entity created' section to provide essential details about the fiduciary overseeing the estate or trust.

- Provide the complete address of the estate or trust, including city, state, and ZIP or foreign postal code. Ensure accuracy in this section to avoid filing issues.

- Select the type of trust by checking the appropriate box, including options such as simple trust, complex trust, or qualified disability trust. If applicable, specify any deductions that apply.

- List all sources of income by filling in the respective lines, such as interest income, ordinary dividends, business income, and capital gains. Attach any necessary schedules to support your entries.

- Calculate total deductions applicable to your estate or trust, ensuring that you complete each relevant section accurately.

- Finalize your taxable income calculation by subtracting total deductions from total income. Enter the result in the appropriate field.

- Complete the tax calculation section using the total taxable income and other applicable inputs. This will determine the overall tax liability.

- Review and confirm all sections of the form for accuracy before moving on to the final steps.

- Once completed, you have the option to save your changes, download the form, or print it. Additionally, consider sharing the form if needed.

Take the next step and file your documents online today!

Federal income tax rates for trusts in 2023 are: For trust income between $0 to $2,900: 10% of income over $0. For trust income between $2,901 to $10,550: $290 + 24% of the amount over $2,901. For trust income between $10,551 to $14,450: $2,126 + 35% of the amount over $10,551.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.