Loading

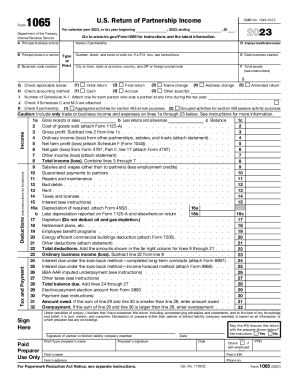

Get 2023 Form 1065

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form 1065 online

This guide provides clear and detailed instructions for filling out the 2023 Form 1065, which is essential for partnerships to report income, deductions, gains, and losses. Follow these steps to complete the form accurately and efficiently.

Follow the steps to fill out Form 1065 effectively.

- Click ‘Get Form’ button to access the form you need and open it in the editor.

- Enter the partnership's name and employer identification number (EIN) in the designated fields at the top of the form.

- Complete sections A and B by providing details about the principal business activity and principal product or service.

- Check the appropriate boxes to indicate the type of return being filed (initial, final, name change, etc.) and select the accounting method used.

- Fill in the total assets and the date the business started in section F and E respectively.

- In the income section, report gross receipts or sales, cost of goods sold, and calculate your gross profit.

- Detail all deductions in the deductions section, including salaries, rent, interest, and other expenses to determine ordinary business income or loss.

- Continue filling out any necessary schedules, such as Schedules K-1, and ensure they are attached to Form 1065.

- Sign the form under penalties of perjury, ensuring that the declaration is true and complete.

- Once all information is filled out, save changes, download the completed form, print it, or share it as necessary.

Start preparing your Form 1065 online today to ensure your partnership meets its filing obligations.

Need Products to Complete Your 2023 Tax Return? You can place your order here for tax forms, instructions and publications. Forms and Publications by U.S. Mail | Internal Revenue Service irs.gov https://.irs.gov › forms-pubs › forms-and-publicatio... irs.gov https://.irs.gov › forms-pubs › forms-and-publicatio...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.