Loading

Get Mn M15np Additional Charge For Underpayment Of Estimated Tax 2023-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN M15NP Additional Charge For Underpayment Of Estimated Tax online

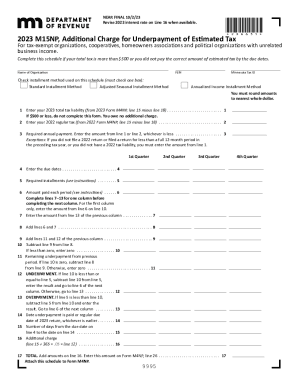

This guide provides a comprehensive overview of how to fill out the MN M15NP Additional Charge For Underpayment Of Estimated Tax form online. It is designed to ensure users correctly complete each section of the form with clarity and confidence.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter your 2023 total tax liability on line 1. This is found on your 2023 Form M4NP, specifically line 15 minus line 18. If the amount is $500 or less, you do not need to complete this form as no additional charge is due.

- On line 2, enter your 2022 regular tax amount from the 2022 Form M4NP, specifically line 15 minus line 18.

- For line 3, enter the required annual payment, which is the lesser of the amounts in line 1 or line 2. Note that if you did not file a 2022 return or had no 2022 tax liability, use the amount from line 1.

- Fill out line 4 with the due dates for the required installments, which are the 15th day of the third, sixth, ninth, and twelfth months of your taxable year.

- On line 5, enter the required installments, which is typically 25% of the amount on line 3 unless you utilize an alternative method.

- On line 6, indicate the amount paid for the first period, making sure to include any overpayment from your 2022 return if applicable.

- For lines 7 to 13, complete each column systematically, ensuring that you enter the previous amounts correctly as instructed.

- Calculate the total charge by entering the required information in lines 14 through 17 to figure out the additional charge and total amounts due.

- Once all information is accurately entered, review your completed form for any errors or omissions.

- Save the changes you made, and then choose to download, print, or share the completed form as needed.

Ensure your estimated tax obligations are met by completing the MN M15NP form online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.