Loading

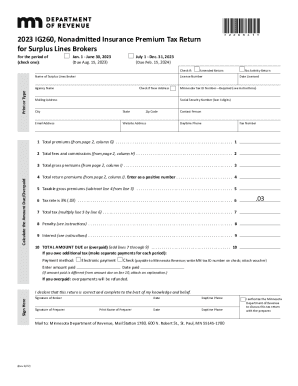

Get Mn Dor Ig260 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR IG260 online

Filling out the MN DoR IG260 form online is a straightforward process that is essential for surplus lines brokers to report nonadmitted insurance premiums accurately. This guide provides detailed, step-by-step instructions to help you complete the form efficiently.

Follow the steps to fill out the MN DoR IG260 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Select the appropriate filing period by checking one of the boxes at the top of the form: either Jan. 1 - June 30, or July 1 - Dec. 31. Note the corresponding due dates.

- Enter your name as the surplus lines broker along with the agency name. Ensure that this information is clear and correctly spelled.

- Fill out your license number and check if you have a new mailing address. Provide your complete mailing address.

- If applicable, check if this is an amended return or a no activity return to indicate that there were no transactions during the reporting period.

- Enter your Minnesota tax ID number, followed by your Social Security number's last four digits, city, state, and zip code. Also provide your email address, website address, contact person's name, and daytime phone number.

- Complete the total premiums section by calculating the amounts for total premiums, total fees, and commissions as instructed based on the data provided on page 2.

- Calculate the total tax due by determining the taxable gross premiums and applying the tax rate. Follow the calculations outlined in the form.

- If you owe any additional taxes, indicate your payment method and fill in the amount paid and the date paid. Ensure this aligns with the amounts calculated earlier.

- Sign and date the form, declaring that it is complete and accurate. Include a signature for the preparer if applicable.

- Review all entries for accuracy and ensure you have included any necessary attachments. You can then save changes, download, print, or share the completed form as required.

Complete your MN DoR IG260 form online today to ensure timely and accurate reporting of your insurance premiums.

If you are a Part year resident or nonresident, you must file if your Minnesota gross income meets the state's minimum filing requirement. Part Year Residents: File a Minnesota income tax return if you moved into or out of Minnesota in 2023 and your 2023 Minnesota source income is $13,825 or more.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.