Loading

Get 202109020s Tax Type: Motor Vehicle Document Type: Statute

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 202109020S Tax Type: Motor Vehicle Document Type: Statute online

Completing the 202109020S Tax Type: Motor Vehicle Document Type: Statute online can be straightforward with the right guidance. This guide provides clear, step-by-step instructions to help users efficiently fill out the necessary fields of the form while ensuring compliance with regulations.

Follow the steps to complete the form accurately and efficiently.

- Click the ‘Get Form’ button to obtain the necessary document and open it in your preferred editor.

- Begin by entering the company legal name and Federal Employer Identification Number (FEIN#) at the designated fields. Ensure accuracy to avoid future discrepancies.

- Provide the business address, including street, city, state, and zip code. If applicable, fill in the mailing address if it differs from the business address.

- Indicate whether the property is rented/leased or owned. If owned, confirm it is under the exact name of your company.

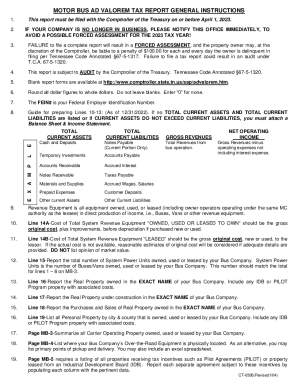

- Input the total current assets and total current liabilities. This is crucial; if these fields are left blank, attach a Balance Sheet and Income Statement as noted.

- Provide gross revenues from bus operations, ensuring that you only enter figures relevant to your operating activities.

- List your total number of System Power Units owned, used, or leased, verifying this number matches previous lines.

- Complete the sections for real property owned, and construction in progress, specifically under the exact name of your company to ensure it aligns with the tax records.

- Summarize all Carrier Operating Property. This includes details for all equipment and properties utilized in your business operations.

- Review all entries meticulously to guarantee accuracy and adherence to compliance requirements, addressing any issues prior to submission.

- Once all sections of the form are complete, save your changes. You can then download, print, or share the completed document as needed.

Start completing your documents online today for a hassle-free process.

Does Selling a Car Count as Income in Texas? In the state of Texas, depending on how much you're able to make when selling your pre-owned vehicle, along with what you used it for, your car sale can be categorized as income or as a sale that must be taxed and filed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.