Loading

Get How To File The Colorado Retail Sales Tax Return ... - Youtube

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

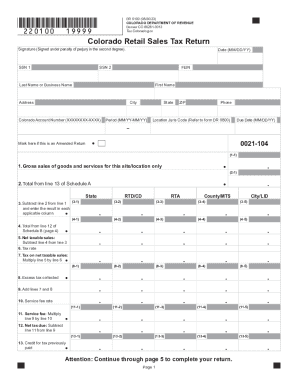

How to fill out the Colorado retail sales tax return online

Filing the Colorado retail sales tax return is essential for retailers to report sales tax accurately. This guide provides a comprehensive overview of how to complete this form effectively, ensuring compliance with state requirements.

Follow the steps to complete your sales tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your identifying information, such as your name, address, and Colorado account number, in the appropriate fields.

- Indicate the filing period for your return, ensuring it is formatted as MM/YY-MM/YY.

- Provide the location jurisdiction code that corresponds to the site where sales occurred.

- Complete the gross sales line by entering your total sales for the filing period. This includes both taxable and non-taxable sales.

- Fill out the tax rate section with the applicable rates based on the local jurisdiction.

- Calculate the tax on net taxable sales by multiplying your net taxable sales by the tax rate you've provided.

- Include any excess tax collected from customers if applicable, in the designated line.

- If eligible, calculate and enter any service fees based on your net taxable sales.

- Review the return for accuracy, ensuring all required fields are completed correctly.

- Once you have verified the accuracy of your information, save your changes, download the completed form, or print it for submission.

Begin filling out the Colorado retail sales tax return online today.

Colorado businesses must collect and remit the full sales tax rate in effect at the location of the consumer — the destination of the sale — when taxable goods are delivered to a Colorado address. Destination sourcing also applies to out-of-state sellers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.