Loading

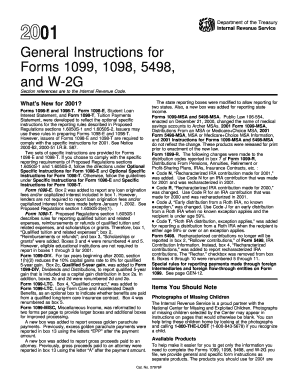

Get 2001 Instructions For 1099 General Instructions - Irs - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Instructions For 1099 General Instructions - IRS online

Filling out the 2001 Instructions for Forms 1099 can be a straightforward process with the right guidance. This guide will provide detailed steps to assist you in accurately completing the form online, ensuring you meet all necessary requirements.

Follow the steps to fill out the 2001 Instructions for 1099 effectively.

- Press the ‘Get Form’ button to obtain the 2001 Instructions For 1099 form and open it in your preferred editor.

- Review the document sections carefully. You will find general information concerning Forms 1099, including filing requirements and new updates for 2001.

- In the section on ‘Who must file’, determine your obligation to file the 1099 forms, ensuring you meet the criteria outlined.

- If corrections are needed in future filings, utilize the specific instructions for corrected returns provided in the guide.

- Finally, once the form is completed, save the document. You may then download, print, share, or submit as necessary based on your filing method.

Complete your documents online to ensure timely and accurate filing.

Penalties for Correcting a 1099 Form The IRS will issue some penalty depending on the type of error and whether it was intentional. A business generally must pay $100 per incident. The business may also pay a separate $100 fee after the IRS sends a statement to any taxpayer who received an incorrect tax form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.