Loading

Get Az Promissory Note 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ Promissory Note online

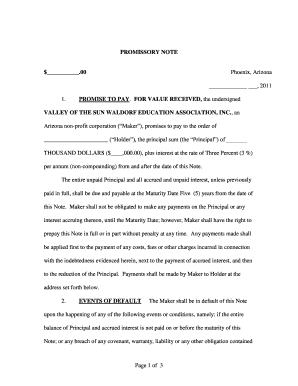

The AZ Promissory Note is a crucial financial document that outlines a borrower's promise to repay a specified amount over a designated time frame. This guide will provide clear steps to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the AZ Promissory Note online.

- Press the ‘Get Form’ button to obtain the AZ Promissory Note and open it in your chosen editor.

- Enter the total amount you are borrowing in the blank space, denoted by $___________.00.

- Fill in the location and date in Phoenix, Arizona, followed by the date you are completing the note.

- In the section labeled ‘Promise to pay,’ enter the name of the holder, who is the entity or individual that will receive the payments.

- Specify the principal sum in words and numerals, noting that it should equate to the amount mentioned in step 2.

- Indicate the interest rate, which is set at three percent (3%) per annum, and confirm that it is non-compounding.

- Clearly state the maturity date, which is five (5) years from the date of the note.

- Complete sections detailing any rights for early payment and how payments will be applied.

- Fill out the section labeled ‘Events of Default’ to explain the conditions under which the borrower may default.

- Review the terms outlined in the sections regarding acceleration, defaults, fees, successors, and governing law.

- Sign the document under the ‘Maker’ section, indicating your name and title, if applicable.

- Provide the name and address of the holder at the end of the document.

- Finally, save, download, or print the completed form for your records.

Complete your AZ Promissory Note online with confidence and ensure your financial agreements are properly documented.

Reporting an AZ Promissory Note on your taxes is straightforward. You should report any interest income earned from the note on Schedule B of your tax return. Additionally, if you sell the note, you may need to report capital gains. Consult a tax professional to ensure compliance, and consider US Legal Forms for resources to keep your financial records accurate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.