Loading

Get Wine And Mixed Beverage Tax Return For A2 B2a And Or ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wine And Mixed Beverage Tax Return For A2 B2a And Or ... online

Filing the Wine And Mixed Beverage Tax Return can be essential for permit holders to ensure compliance with state tax regulations. This guide provides a clear and structured approach to completing the form accurately and efficiently.

Follow the steps to effectively fill out the form.

- Click 'Get Form' button to access the document and open it in your preferred editing tool.

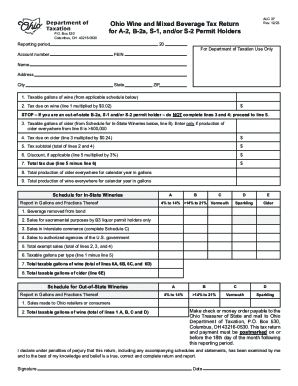

- Fill in the reporting period at the top of the form, ensuring to indicate the appropriate month and year. Next, enter your account number and Federal Employer Identification Number (FEIN).

- Provide your name, address, city, state, and ZIP code accurately to identify your business.

- In line 1, report the taxable gallons of wine by referencing the applicable schedule. This may require calculating based on sales and production.

- Calculate the tax due on wine by multiplying the amount from line 1 by $0.02 and enter this value in line 2.

- If you are an out-of-state B-2a, S-1, and/or S-2 permit holder, skip lines 3 and 4. Otherwise, proceed to line 3 if your cider production exceeds 500,000 gallons. Report the taxable gallons of cider from your schedule.

- For line 4, calculate the tax due on cider by multiplying the amount from line 3 by $0.24.

- In line 5, add the totals from lines 2 and 4 to find your tax subtotal.

- If applicable, calculate any discounts by taking 3% of the total from line 5 and enter it in line 6.

- Determine the total tax due by subtracting the discount (line 6) from the tax subtotal (line 5) and enter this amount in line 7.

- Complete lines 8 and 9 to provide total production figures for cider and wine for the calendar year in gallons.

- Review all entries for accuracy. Once finalized, you may save your changes, download the completed form, print it, or share it as needed.

Ensure compliance by completing your Wine And Mixed Beverage Tax Return online today!

Beverages and Water – Taxable and Nontaxable Soft drinks are taxable and include: Carbonated and non-carbonated, non-alcoholic beverages that contain natural or artificial sweeteners. Canned, bottled, frozen or powdered drinks and drink mixes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.