Get Form Oic B-2 - Business Offer In Compromise - Virginia Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form OIC B-2 - Business Offer In Compromise - Virginia Tax online

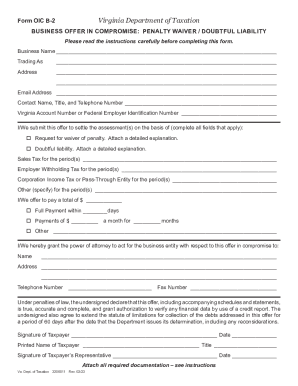

The Form OIC B-2 is designed for businesses in Virginia seeking to settle tax assessments through an offer in compromise. This guide provides a detailed, step-by-step approach to filling out the form online, ensuring you have the necessary information to complete it accurately and efficiently.

Follow the steps to complete the Form OIC B-2 online.

- Press the ‘Get Form’ button to obtain the Form OIC B-2 and open it in your preferred online editor.

- Enter the business name in the designated field, followed by the trading name if applicable.

- Fill in the business address, ensuring that all components such as street address, city, state, and zip code are included.

- Provide a current email address in the space allocated for communication purposes.

- Include the contact name, title, and telephone number of the individual handling the offer.

- Enter either the Virginia account number or the federal employer identification number in the provided field.

- Indicate the basis for your offer by checking the appropriate boxes for penalty waiver or doubtful liability. Attach detailed explanations for these claims.

- Specify the tax types and periods for which you are submitting this offer, accurate to the necessary detail.

- State the total amount you are offering to pay and describe your payment plan — whether full payment within a certain number of days, monthly payments, or another option.

- Designate a power of attorney if applicable by filling in the name, address, and contact details of the individual or firm you are authorizing.

- Read the declaration statement carefully, then sign and date the form as well as have your representative sign if someone is submitting on your behalf.

- Attach all required documentation as outlined in the instructions.

- Once you’ve confirmed that all information is complete, save your changes, and have the option to download, print, or share the completed form.

Complete your Form OIC B-2 online today to settle your Virginia tax assessment.

The cons include: Not everyone qualifies for OIC. This method is typically best for people who have very few assets and who are low income earners. With this method, you are able to reduce what you owe. However, you also surrender your right to tax credits that you may have access to each year. What Are the Pros and Cons of Offer in Compromise? - - Steburg Law Firm steburglawfirm.com https://.steburglawfirm.com › faq › what-are-the-pr... steburglawfirm.com https://.steburglawfirm.com › faq › what-are-the-pr...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.