Loading

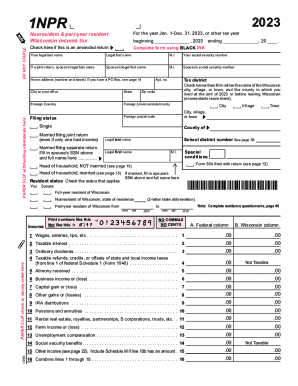

Get 2023 I-050 Form 1npr-nonresident & Part-year Resident - Wisconsin Income Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 I-050 Form 1NPR-Nonresident & Part-year Resident - Wisconsin Income Tax online

Completing the 2023 I-050 Form 1NPR for nonresidents and part-year residents of Wisconsin can be straightforward if you follow the right steps. This guide will provide clear instructions to ensure your online filing is accurate and efficient.

Follow the steps to complete your tax form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your legal first name, last name, and middle initial in the designated fields. If you are filing jointly, include your spouse's name and Social Security number.

- Provide your home address, including city, state, and ZIP code. If you have a PO Box, refer to the instructions for guidance.

- Select your filing status: single, married filing joint, married filing separately, head of household, or other, depending on your circumstances.

- Indicate your residency status by checking the appropriate box for full-year resident, nonresident, or part-year resident.

- In the income section, report your wages, salaries, and other income types in the federal and Wisconsin columns, ensuring you follow the formatting prompts.

- Complete the adjustments to income section, if applicable, by entering amounts in the corresponding fields for deductions such as health savings account or student loan interest.

- Calculate your Wisconsin income tax by following the instructions for the tax computation portion, taking into account any credits you may qualify for.

- At the end of the form, fill out the signature area. Each filing party must sign and date the return. If applicable, include a Wisconsin Identity Protection PIN.

- Once you have thoroughly reviewed your entries for accuracy, save your changes. You then have the option to download, print, or share the completed form for submission.

Start completing your documents online today!

Nonresidents - Wisconsin taxes only your income from Wisconsin sources. Part-year residents - During the time you are a Wisconsin resident, Wisconsin taxes your income from all sources. During the time you are not a resident of Wisconsin, Wisconsin only taxes your income from Wisconsin sources.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.