Loading

Get 2023 Form Rew-5 - Maine.gov

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2023 Form REW-5 - Maine.gov online

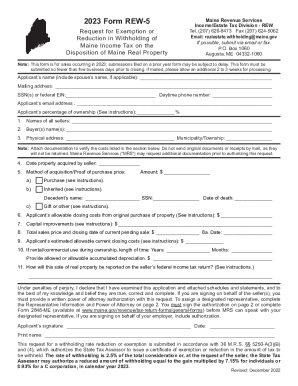

Filling out the 2023 Form REW-5 is essential for those seeking an exemption or reduction in withholding of Maine income tax on the disposition of Maine real property. This guide provides a step-by-step approach to assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete your Form REW-5 online.

- Click the 'Get Form' button to access the form and open it in your preferred editor.

- Enter the applicant’s name in the designated field. If applicable, include the name of your partner.

- Fill in the mailing address where you can receive correspondence regarding this form.

- Provide the social security number (SSN) or federal employer identification number (EIN) for the applicant.

- Input the daytime phone number and email address for the applicant to ensure contactability.

- Enter the applicant’s percentage of ownership as specified in the instructions.

- List the names of all sellers involved in the transaction.

- Include the names of the buyer(s) that are listed in the Purchase and Sale Agreement.

- Fill in the physical address of the property to be sold, along with the municipality or township name.

- Provide the date when the seller acquired the property.

- Select the method by which the property was acquired (purchase, inherited, gift).

- Input the allowable closing costs associated with the original purchase of the property.

- List any capital improvements made to the property, along with the associated costs.

- Enter the total sales price of the property and the closing date of the pending sale.

- approximate the allowable closing costs for the current sale of the property.

- If the property was rented or used for commercial purposes, indicate the duration of this usage and any related depreciation.

- Indicate how the sale will be reported on the seller's federal income tax return.

- Sign and date the form to certify the accuracy of all provided information. If applicable, include a power of attorney authorization if signing on behalf of another.

- Review the completed form for any errors or missing information.

- Save any changes made to the form, then download, print, or share it as needed.

Complete your Form REW-5 online today for a streamlined submission process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The 2023 Maine personal exemption amount is $4,700 and the Maine basic standard deduction amounts are $13,850* for single and $27,700* for married individuals filing joint returns. Maine Revenue Services Withholding Tables for Individual Income Tax maine.gov https://.maine.gov › inline-files › 23_wh_tab_instr maine.gov https://.maine.gov › inline-files › 23_wh_tab_instr

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.