Loading

Get Wi I-017i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI I-017i online

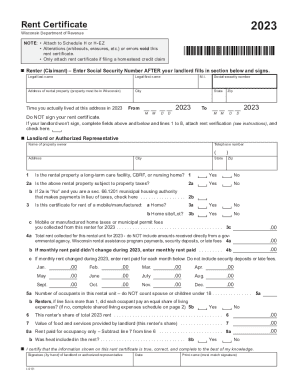

Filling out the WI I-017i form correctly is essential for claiming your rent credit in Wisconsin. This guide provides step-by-step instructions to help you navigate the online process with ease and confidence.

Follow the steps to successfully complete the WI I-017i form.

- Click 'Get Form' button to obtain the form and open it in your preferred online editor.

- Begin by filling in the 'Renter (Claimant)' section. Enter your legal last name, first name, and the address of the rental property. Ensure the property is located in Wisconsin.

- Indicate the duration of your residency at this address during 2023 by filling in the start and end dates.

- Do not sign the rent certificate yourself. Wait for your landlord to fill in their details and sign the form. If your landlord cannot sign, complete the necessary fields and check the designated box.

- Fill out the 'Landlord or Authorized Representative' section. Enter the name, telephone number, and address of your landlord or their representative.

- Answer the questions about the rental property, including if it is a long-term care facility and if it is subject to property taxes. Provide relevant details for any additional questions.

- Complete the financial sections indicating the total rent collected for 2023, monthly rent, and any relevant information on shared living expenses.

- If applicable, fill out the 'Shared Living Expenses Schedule' only if the shared expenses do not meet the criteria stated in line 5b. Provide details on the amounts shared with other occupants.

- Review all entries for accuracy. Once the form is complete, save your changes, download the document, and print it if necessary.

- Share the completed WI I-017i form with your landlord, ensuring they sign it before submitting it with your Schedule H or Schedule H-EZ.

Start filling out your WI I-017i online today to ensure your homestead credit is processed smoothly.

The maximum credit allowed is $1,168. Household income includes all taxable and certain nontaxable income, less a deduction of $500 for each qualifying dependent. If household income is $24,680 or more, no credit is available. Property taxes are those levied for 2022, regardless of when they are paid.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.