Loading

Get Git/rep-3 Seller's Residency Certification/exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GIT/REP-3 Seller's Residency Certification/Exemption online

Filling out the GIT/REP-3 Seller's Residency Certification/Exemption is an essential step for individuals, estates, or trusts selling or transferring property in New Jersey. Completing this form online can streamline the process and ensure that you meet the necessary requirements outlined by the New Jersey Division of Taxation.

Follow the steps to complete the form with ease.

- Press the ‘Get Form’ button to access the GIT/REP-3 form and open it in your document editor.

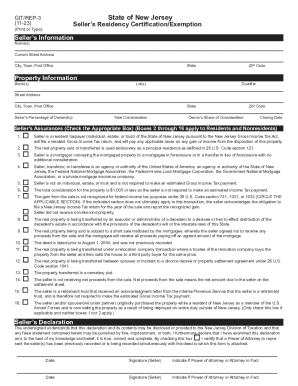

- Enter the seller's information. This includes the name(s) of the seller(s) and the current street address. Ensure that the address provided is the seller's primary residence and not the address of the property being sold.

- Fill in the property information. This section requires you to provide details such as the block and lot numbers associated with the property, as well as the city or town, state, and ZIP code.

- Indicate the seller’s percentage of ownership in the property and the total consideration for the property, which refers to the total compensation for the transfer of title.

- Complete the Seller’s Assurances section by checking the appropriate box. This section needs to reflect any relevant assurance that applies to your situation regarding the transaction.

- Provide the seller's declaration by signing and dating the form. If a Power of Attorney is involved, ensure that relevant documentation is attached or previously recorded.

- After filling out the form, review all entries for accuracy and completeness. Once confirmed, save your changes, download, print, or share the document as needed.

Complete your GIT/REP-3 form online today and ensure a smooth transaction.

Seller's Residency Certification/Exemption Instructions Individuals, estates, trusts, or any other entity selling or transferring property in New Jersey must complete this form if they are not subject to the Gross Income Tax estimated payment requirements under N.J.S.A.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.