Loading

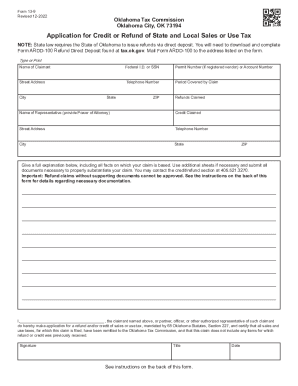

Get Form 13-9 Application For Credit Or Refund Of State And Local Sales Or Use Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13-9 Application For Credit Or Refund Of State And Local Sales Or Use Tax online

Filling out the Form 13-9 Application For Credit Or Refund Of State And Local Sales Or Use Tax can seem daunting, but with clear guidance, you can complete it efficiently. This guide provides you with step-by-step instructions to help you successfully navigate the online application process.

Follow the steps to complete the application form accurately and effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including the name of the claimant, federal ID or social security number, and permit number or account number if you are a registered vendor. Ensure that all details are accurate.

- Fill in your street address, city, state, and ZIP code, along with your telephone number. This information is necessary for contact purposes.

- Indicate the period covered by your claim. This date range is crucial for determining the validity of your refund request.

- Specify the amounts for refunds and credit claimed. If you are claiming both a refund and a credit, delineate the amounts clearly.

- If applicable, provide the name and contact information for your representative, ensuring that any necessary power of attorney documentation is included.

- In the space provided, give a detailed explanation supporting your claim. Use additional sheets if needed and attach any relevant documents necessary to substantiate your request.

- Review the signature section to ensure that the claimant, partner, officer, or other authorized representative of the claimant has signed and dated the form.

- Once all sections are completed, you may save changes, download, print, or share the completed form as needed.

Start completing your Form 13-9 online today for an efficient credit or refund process.

Oklahoma law requires remote sellers to collect Oklahoma sales and use tax on their sales into the state.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.