Loading

Get Alabama Business Privilege Tax Initial Return Form ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Business Privilege Tax Initial Return Form online

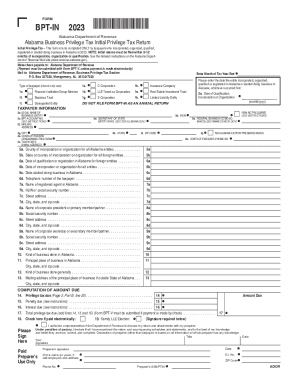

This guide provides a comprehensive overview of how to complete the Alabama Business Privilege Tax Initial Return Form (BPT-IN) online. It is designed for users of all experience levels to navigate the process with confidence.

Follow the steps to successfully complete your form.

- Press the ‘Get Form’ button to access the Alabama Business Privilege Tax Initial Return Form. This will open the form in your editing tool.

- Begin by indicating the type of taxpayer. Check only one box that best represents your entity, such as C Corporation, S Corporation, or Disregarded Entity.

- Enter the month of the tax year end and the date of incorporation, organization, qualification, or the start of business in Alabama using the format mm/dd/yyyy.

- Fill out the taxpayer information section with the legal name of your business entity, Federal Employer Identification Number (FEIN), and contact details including mailing address, email address, and phone number.

- Complete the section regarding net worth computation. Depending on your entity type, fill out the relevant parts with the proper financial details regarding issued capital stock, retained earnings, and compensation details.

- Attach any necessary supporting documentation as indicated in the form for exclusions and deductions to ensure accurate calculations.

- Calculate the total privilege tax due by following the instructions for the computations section. Make sure to add any penalties or interest if applicable.

- Review all entries for accuracy, ensure you have signed the form, and authorize any representatives if necessary.

- Once you have completed all sections and verified the information, save your changes. Depending on your needs, you can download, print, or share the completed form.

Complete your Alabama Business Privilege Tax Initial Return Form online to ensure timely submission.

How do I make a Payment for Business Privilege Tax? Payment Options. My Alabama Taxes. Pay via Credit/Debit card or ACH online with MyAlabamaTaxes. ... By Phone. ... By Mail.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.