Loading

Get Https://tax.alaska.gov/programs/programs/forms/ind...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Alaska Corporation Net Income Tax Return online

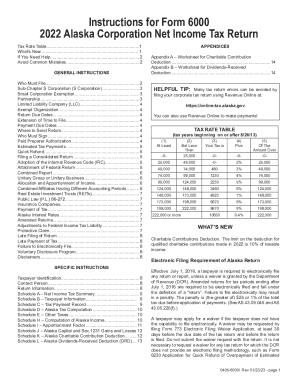

Filing the 2022 Alaska Corporation Net Income Tax Return can be a straightforward process when you know the steps involved. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently, ensuring compliance with Alaska tax regulations.

Follow the steps to effectively fill out the form online.

- Click the ‘Get Form’ button to access the Https://tax.alaska.gov/programs/programs/forms/ind... and open it in the editor.

- Begin by entering your taxpayer identification details, including your business name and federal Employer Identification Number (EIN). Make sure this matches the entity that has nexus in Alaska.

- Provide the contact person's information, ensuring it is an authorized individual capable of discussing any queries with the Department of Revenue (DOR). This includes their name, email address, and phone number.

- Check applicable boxes in the 'Return Information' section, such as if this is a final return, amended return, or if claiming the small corporation exemption. Ensure you understand the implications of each selection.

- Complete Schedule A, Net Income Tax Summary, detailing your taxable income and any deductions, such as the Alaska net operating loss. Attach Form 6385 if applicable.

- Input taxpayer information in Schedule B if filing a consolidated return. List members of the Alaska consolidated group, indicating their nexus activities.

- Fill out Schedule C to record your tax payment history, ensuring totals align with Schedule A.

- Proceed to Schedule D, where you will compute your Alaska taxable income using the tax rate table provided. Pay attention to any specific exemptions or deductions.

- Continue with Schedule E for reporting any other applicable taxes, and notify how these relate to your corporate operations in Alaska.

- Finalize by reviewing all sections for accuracy, then save changes, and utilize options to download, print, or share the completed form.

Start filing your corporate tax returns online today for a smoother tax season!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Alaska does not have an individual income tax. Alaska has a 2.0 to 9.40 percent corporate income tax rate. Alaska does not have a state sales tax, but has a max local sales tax rate of 7.50 percent and an average combined state and local sales tax rate of 1.76 percent.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.