Loading

Get Irs 5310-a 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5310-A online

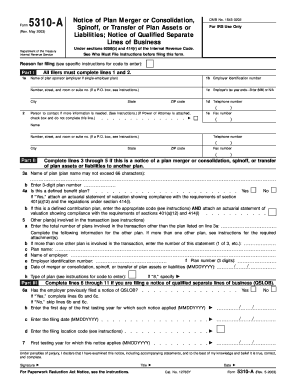

The IRS 5310-A form is essential for notifying the Internal Revenue Service about plan mergers, consolidations, spinoffs, or transfers of plan assets or liabilities. This guide provides step-by-step instructions to help you complete the form accurately and efficiently via an online platform.

Follow the steps to complete the IRS 5310-A form online.

- Click the ‘Get Form’ button to access the form and open it in your browser.

- Continue in Part I by entering the employer’s tax year end in line 1c, a contact telephone number in line 1d, and a fax number in line 1e.

- In line 2, provide the name and address of the person to contact for further information. If a Power of Attorney is attached, check the corresponding box.

- Part II requires you to complete lines 3 through 5 if this is regarding a plan merger or consolidation. Begin by naming the plan on line 3a and entering the plan number in line 3b.

- In line 4, indicate whether this is a defined benefit plan by selecting ‘Yes’ or ‘No’. If ‘Yes’, attach the necessary actuarial statement.

- If this is a defined contribution plan, complete section 4b by entering the appropriate code and attaching an actuarial statement.

- Provide details about other plans involved in the transaction in lines 5a through 5h. Include the names, employer identification numbers, and types of plans as needed.

- In Part III, answer question 6 to indicate if the employer has filed a notice of Qualified Separate Lines of Business (QSLOB) previously. If applicable, complete the subsequent lines as directed.

- Conclude with your declaration under penalties of perjury by signing and dating the form, and including your title in the designated section.

- Once you have completed the form, you can save your changes, download a copy for your records, print it out, or share it as needed.

Take the next step and complete your IRS 5310-A form online today.

Related links form

Plan sponsors or administrators of pension, profit-sharing, or 403(b) plans use Form 5310 to ask the IRS to make a determination on the plan's qualification status at the time of the plan's termination.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.