Loading

Get Mo Mo-3nr 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-3NR online

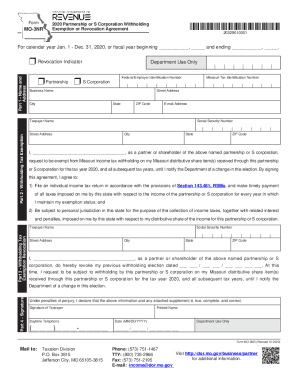

The MO MO-3NR form is essential for nonresident partners and shareholders of partnerships or S corporations requesting an exemption from Missouri income tax withholding. This guide provides a clear, step-by-step approach to filling out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to complete the MO MO-3NR online.

- Click the ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part 1, enter the name of the partnership or S corporation. Indicate whether it is a partnership or S corporation, and provide the federal employer identification number along with the Missouri tax identification number if applicable. Fill out the business name, address, city, state, ZIP code, and email address.

- For Part 2, provide your name, social security number, and address. As a partner or shareholder, indicate your request for exemption from Missouri income tax withholding on your distributive share items. Read and acknowledge the agreement conditions by signing your name in Part 4.

- If you are revoking a previous withholding exemption, complete Part 3 by providing your name, social security number, and address once more. State your intent to revoke the exemption from withholding and indicate the date of your previous election.

- In Part 4, ensure that you sign and date the document. Include a daytime telephone number where you can be reached for any inquiries from the Department regarding your agreement.

- After completing all required sections, save your changes. You may choose to download the form, print it, or share it as necessary before submitting it to the Taxation Division at the provided mailing address.

Start filling out your MO MO-3NR form online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Obtaining a 501 (c) exemption A 501(c) is an Internal Revenue Service (IRS) exemption, if you have not received an exemption letter from the IRS, you can obtain Form 1023, Application for Recognition of Exemption, by visiting their web site at http://.irs.gov/ or call 877-829-5500.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.