Loading

Get Al Dor Form A-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL DoR Form A-1 online

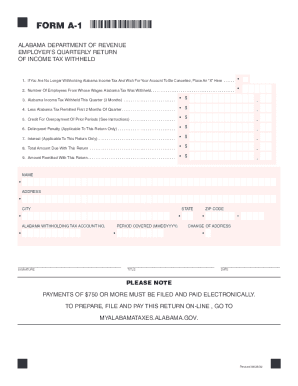

Filling out the AL DoR Form A-1 online is a straightforward process that allows users to submit their employer's quarterly return of income tax withheld in an efficient manner. This guide provides clear, step-by-step instructions to help you complete the form accurately.

Follow the steps to complete the AL DoR Form A-1 online.

- Press the ‘Get Form’ button to download the form and open it in your browser.

- Begin by indicating if you are no longer withholding Alabama income tax. If applicable, place an 'X' in the appropriate box provided.

- Enter the number of employees from whom Alabama tax was withheld during the quarter in the designated field.

- Report the total amount of Alabama income tax withheld for the quarter in the specified area.

- Input the amount of Alabama tax that was remitted during the first two months of the quarter.

- If applicable, include any credit for overpayment of prior periods in the appropriate field.

- Calculate and enter any delinquent penalties that apply to this return.

- Include any interest applicable to this return in the designated spot.

- Summarize the total amount due with this return in the relevant section.

- Finally, indicate the amount you are remitting with this return.

- Fill out your name, address, city, state, Alabama withholding tax account number, and the period covered.

- Sign the document, provide your title, and indicate the date.

- Review all entries for accuracy, then save your changes, download, or print the completed form as needed.

Complete your AL DoR Form A-1 online today for a seamless filing experience.

Related links form

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.