Loading

Get Ca Ftb 3555 1998-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3555 online

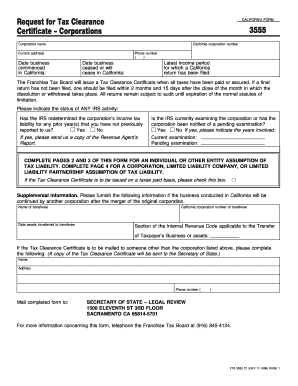

The CA FTB 3555 form is essential for corporations seeking a tax clearance certificate in California. This guide provides step-by-step instructions on how to appropriately complete the form online, ensuring that you have all necessary information at hand and an understanding of each section.

Follow the steps to complete the CA FTB 3555 form online.

- Press the ‘Get Form’ button to access the CA FTB 3555 form and open it in your preferred online editor.

- Enter the corporation name in the designated field. Ensure that the name matches official records to prevent processing delays.

- Input the California corporation number accurately. This number is critical for identifying your corporation within state records.

- Fill in the current address of the corporation. Make sure this address is up-to-date and reflects the corporation's main operating location.

- Specify the date the business commenced in California. This date is important for establishing the timeline of your business activities.

- Provide a contact phone number where the corporation can be reached for any necessary follow-ups.

- Indicate the date when the business ceased operations in California or when it will cease. If applicable, be sure to include all necessary documentation.

- Enter the latest income period for which a California return has been filed to establish a record of compliance.

- Respond to the questions regarding IRS activity. Indicate if the IRS has redetermined your income tax liability for any prior years or if there is an ongoing examination.

- Complete pages 2 and 3 for individual or other entity assumption of tax liability, or page 4 for corporations, LLCs, or LLPs.

- If the tax clearance certificate should be mailed to someone other than the corporation, fill in their name and address in the appropriate fields.

- Review the form for completeness and accuracy. Ensure all relevant fields are filled out and that there are no missing details.

- Once you have filled out the form completely, you can save your changes, download, print, or share the form as needed.

Complete your CA FTB 3555 online today to ensure timely processing of your tax clearance certificate.

Related links form

Processing of a Tax Clearance Certificate can take approximately 15 business days to complete (i.e., log the request, research the tax rolls and type correspondence). Upon completion of this process, the Treasurer and Tax Collector will mail you notice of any tax amount due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.