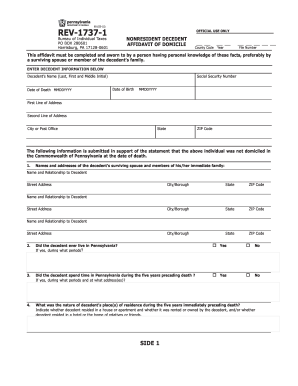

Get PA REV-1737-1 2015

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Jointly online

How to fill out and sign Decedent online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax form filling out can become a significant challenge and serious headache if no appropriate guidance provided. US Legal Forms has been produced as an web-based option for PA REV-1737-1 e-filing and provides multiple advantages for the taxpayers.

Utilize the tips about how to fill out the PA REV-1737-1:

-

Discover the template on the site in the specific section or via the Search engine.

-

Select the orange button to open it and wait until it?s done.

-

Go through the blank and pay attention to the instructions. In case you have never completed the template before, follow the line-to-line recommendations.

-

Concentrate on the yellow fields. They are fillable and require certain info to become inserted. If you are not sure what information to place, see the instructions.

-

Always sign the PA REV-1737-1. Make use of the built in tool to generate the e-signature.

-

Click the date field to automatically insert the relevant date.

-

Re-read the sample to check on and change it just before the e-filing.

- Click the Done button in the upper menu if you have accomplished it.

-

Save, download or export the completed template.

Use US Legal Forms to guarantee comfortable and easy PA REV-1737-1 filling out

How to edit Probate: customize forms online

Choose a rock-solid file editing option you can trust. Modify, execute, and sign Probate safely online.

Very often, editing forms, like Probate, can be a challenge, especially if you received them online or via email but don’t have access to specialized tools. Of course, you can find some workarounds to get around it, but you can end up getting a form that won't meet the submission requirements. Using a printer and scanner isn’t an option either because it's time- and resource-consuming.

We offer an easier and more streamlined way of completing forms. A rich catalog of document templates that are straightforward to change and certify, and then make fillable for other individuals. Our solution extends way beyond a set of templates. One of the best aspects of using our services is that you can change Probate directly on our website.

Since it's an online-based option, it spares you from having to download any software program. Plus, not all corporate policies allow you to install it on your corporate laptop. Here's the best way to easily and safely execute your documents with our platform.

- Click the Get Form > you’ll be immediately taken to our editor.

- As soon as opened, you can start the customization process.

- Choose checkmark or circle, line, arrow and cross and other choices to annotate your form.

- Pick the date field to include a specific date to your template.

- Add text boxes, graphics and notes and more to complement the content.

- Utilize the fillable fields option on the right to add fillable {fields.

- Choose Sign from the top toolbar to create and add your legally-binding signature.

- Click DONE and save, print, and pass around or download the document.

Forget about paper and other inefficient ways of modifying your Probate or other forms. Use our tool instead that combines one of the richest libraries of ready-to-customize templates and a powerful file editing services. It's easy and safe, and can save you lots of time! Don’t take our word for it, try it out yourself!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing issuance

Optimize the time-consuming document preparation processes by following simple tips in this video guide. Get and fill out your codicil online. Make it quick, easy, and accurate.

Resided FAQ

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to PA REV-1737-1

- harrisburg

- DECEDENTS

- codicils

- indenture

- issuance

- codicil

- resided

- municipality

- jointly

- affiliations

- DOMICILE

- decedent

- Probate

- intangible

- preceding

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.