Loading

Get Orec Conventional Loan 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OREC Conventional Loan online

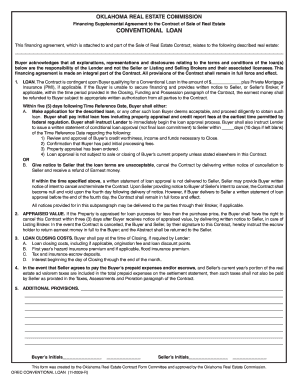

Filling out the OREC Conventional Loan online is an important step in the purchase process for real estate. This comprehensive guide provides detailed instructions on each section of the form, ensuring you are well-equipped to complete it accurately and efficiently.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the OREC Conventional Loan and open it in your editor.

- In the first section of the form, you will need to enter the amount of the loan you are seeking. This includes any applicable Private Mortgage Insurance (PMI). Make sure to specify the exact figure in the designated field.

- Acknowledge the responsibility of the lender regarding terms and conditions by checking the appropriate box, indicating you understand that the seller and brokers are not liable.

- Instruct your lender to begin loan approval by selecting available options and filling out your details within five days following the time reference date. Be sure to provide necessary documents and responses regarding creditworthiness and initial fees.

- Check and provide a written statement of conditional loan approval to the seller within the specified timeframe. Input dates and necessary validations to avoid delays.

- If the loan terms are unacceptable, provide written notice to the seller as instructed. This may involve filling out a cancellation notice and ensuring it is delivered properly.

- If the appraisal comes in lower than the purchase price, you have the right to cancel the agreement. Make sure to document this within three days of receiving the appraisal notice.

- Calculate and input any closing costs, including origination fees and insurance premiums, which should be paid at the closing. Verify these fees thoroughly before submission.

- Review additional provisions that may be applicable to your agreement in the designated section. Ensure you leave no fields blank and clarify any required information.

- Once all sections are completed, save your changes. You can then download, print, or share the OREC Conventional Loan form as needed.

Complete your documents online for a streamlined real estate transaction.

Realtors often prefer OREC Conventional Loans because they typically allow for quicker closings and involve fewer restrictions. Conventional loans usually appeal to a wider range of buyers and are less dependent on government regulations. This can simplify the transaction process and provide more flexibility in negotiations, benefiting both sellers and buyers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.