Loading

Get Au Ing Im271 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AU ING IM271 online

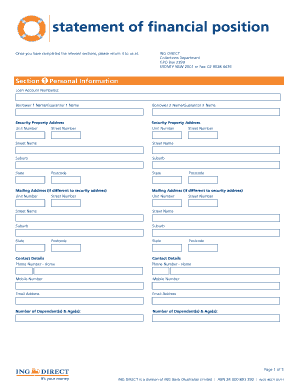

Filling out the AU ING IM271 form online is a straightforward process that ensures your financial information is accurately documented. This guide provides step-by-step instructions to help you navigate and complete each section of the form with confidence.

Follow the steps to successfully complete your AU ING IM271 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section 1: Personal Information. Enter your loan account number(s), and provide the names of the borrowers and guarantors. Include the security property address and any mailing address that differs from the security address. Don't forget to add your contact details such as phone number, mobile number, and email address, as well as the number and ages of any dependents.

- Move to Section 2: Employment Information. For each borrower and guarantor, detail the employer's name and address. If self-employed, input your business address. Include the employer's phone number, your position, and how long you have been at your current job.

- In Section 3: Contact Details of any Authorised Agents, provide the name, phone number, fax number, and email address of the authorized agents, if applicable.

- Section 4: Alternative Contact Person allows you to list a relative or friend, not residing with you. Include their contact information and note that they should be aware of being listed.

- Proceed to Section 5: Assets and Monthly Expenses. Document your assets, their values, and monthly investment income. Include any properties and vehicles, along with other relevant assets. Provide a detailed list of your liabilities and monthly expenses, including loan repayments and living expenses.

- In Section 6: Your Income Details, report the income for each borrower and guarantor. Detail PAYG income and any other sources such as pension or investment income. Calculate total income, ensuring to convert amounts to monthly figures where necessary.

- Section 7: Further Details involves explaining any hardship requests and repayment proposals. List any arrangements with other credit providers if applicable.

- Finally, Section 8: Declarations requires you to declare that the information provided is true and correct. Each borrower and guarantor must add their signature and date the form.

- Once you have completed all relevant sections, you can save your changes, download the form, print it, or share it as necessary.

Complete your AU ING IM271 form online today to ensure your financial matters are handled efficiently.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.