Loading

Get Ca Ftb 2917 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 2917 online

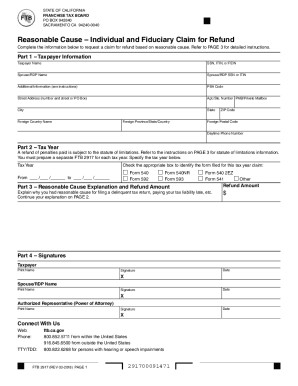

The CA FTB 2917 form, also known as the Reasonable Cause – Individual and Fiduciary Claim for Refund, is an important document for individuals and fiduciaries seeking a refund based on reasonable cause. This guide will provide you with clear and detailed instructions on how to complete the form online effectively.

Follow the steps to successfully complete the CA FTB 2917 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Part 1 – Taxpayer Information: Enter your details as they appear on your tax return. This includes your name, social security number (SSN), or individual taxpayer identification number (ITIN). If applicable, also include your partner's name and their SSN or ITIN, along with your address and contact information.

- Part 2 – Tax Year: Specify the tax year for your request. Make sure to prepare a separate FTB 2917 for each tax year you are claiming.

- Check the appropriate box for the form filed for that tax year, such as Form 540 or Form 592, among others.

- Part 3 – Reasonable Cause Explanation and Refund Amount: Provide a detailed explanation of the reasonable cause for your refund request. State clearly why you filed your taxes late or paid your tax liability after the due date. Include the refund amount you are requesting.

- Part 4 – Signatures: Ensure both the taxpayer and spouse or registered domestic partner (if applicable) sign the form. Include the date of signature. If an authorized representative is filing on behalf of an individual or fiduciary, include their information and signature as well.

- Review all information for accuracy and completeness. Make sure to attach any necessary supporting documentation that validates your claim for refund.

- Once satisfied with the entries, save your changes. You can then download, print, or share the completed form as required.

Complete your CA FTB 2917 online today to ensure your claim is processed efficiently.

The FTB defines “reasonable cause” to mean that the taxpayer exercised ordinary business care and prudence in meeting their tax obligations but failed to comply. A taxpayer may file for a pre-payment penalty waiver or a post-payment wavier, in the event the taxpayer has already paid the tax penalty in full.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.