Get Hi Schedule K-1 Form N-35 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign HI Schedule K-1 Form N-35 online

How to fill out and sign HI Schedule K-1 Form N-35 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

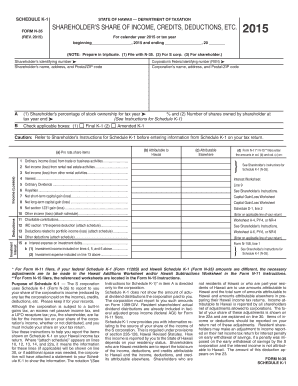

Recording your earnings and providing all the essential tax documents, including HI Schedule K-1 Form N-35, is a responsibility exclusive to U.S. citizens.

U.S. Legal Forms simplifies your tax administration, making it more accessible and accurate.

Keep your HI Schedule K-1 Form N-35 safe. Ensure that all relevant documents and information are organized while adhering to the deadlines and tax regulations established by the IRS. Streamline the process with U.S. Legal Forms!

- Obtain HI Schedule K-1 Form N-35 from your browser on your device.

- Access the fillable PDF form with a single click.

- Start filling out the online template box by box, following the instructions of the sophisticated PDF editor's user interface.

- Enter text and numerical data accurately.

- Choose the Date field to automatically set the current date or adjust it manually.

- Utilize Signature Wizard to create your personalized e-signature and validate it in seconds.

- Refer to the Internal Revenue Service guidelines if you have any remaining questions.

- Click on Done to save your changes.

- Proceed to print the document, save it, or share it via email, text message, fax, or postal service without closing your browser.

How to Modify Get HI Schedule K-1 Form N-35 2015: Personalize Documents Online

Bid farewell to an outdated paper-driven method of completing Get HI Schedule K-1 Form N-35 2015. Get the paperwork filled in and endorsed swiftly with our superior online editor.

Are you facing difficulties in editing and finalizing Get HI Schedule K-1 Form N-35 2015? With our expert editor, you can accomplish this in just a few minutes without the hassle of printing and scanning documents back and forth. We offer you fully modifiable and user-friendly document templates that serve as a foundation and assist you in filling out the required form online.

All templates inherently include fillable fields you can work on right after opening. However, if you wish to refine the existing content of the document or add new information, you can select from a multitude of customization and annotation options. Emphasize, blackout, and remark on the document; insert checkmarks, lines, text boxes, graphics, notes, and comments. Furthermore, you can swiftly validate the template with a legally-binding signature. The finalized form can be shared with others, stored, imported to external applications, or converted into various formats.

You won’t regret using our web-based tool to complete Get HI Schedule K-1 Form N-35 2015 because it's:

Don’t spend time completing your Get HI Schedule K-1 Form N-35 2015 using the traditional method - with paper and a pen. Instead, take advantage of our feature-rich solution. It provides an extensive array of editing options, integrated eSignature features, and user-friendliness. What distinguishes it from other similar solutions is the team collaboration functionalities - you can collaborate on documents with anyone, establish a well-structured document approval workflow from the ground up, and much more. Experience our online solution and derive maximum value for your investment!

- Easy to set up and operate, even for individuals who haven’t filled out documents digitally before.

- Versatile enough to cater to various editing requirements and document types.

- Protected and secure, ensuring your editing experience is safeguarded every single time.

- Accessible on different devices, making it effortless to finish the document from anywhere.

- Able to generate forms using pre-made templates.

- Compatible with an array of document formats: PDF, DOC, DOCX, PPT, and JPEG, among others.

Get form

Related links form

Generally, you do not report your state tax return itself as income. However, income reported on payments from partnerships or S-corporations should be reported, particularly when using the HI Schedule K-1 Form N-35. This ensures you disclose all sources of income properly. It is important to keep accurate records to facilitate a smooth filing process.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.