Loading

Get Ny Dtf Ct-3 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-3 online

Filing the NY DTF CT-3 form is an important step for general business corporations in New York State. This comprehensive guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to fill out the NY DTF CT-3 online.

- Use the ‘Get Form’ button to obtain the CT-3 form and open it in your preferred editor.

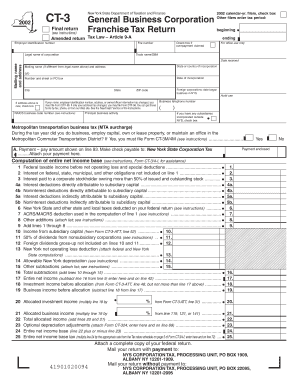

- Begin by checking the appropriate box for your filing period, either as a 2002 calendar-year filer or by entering your specific tax period.

- Enter your employer identification number and file number in the designated fields. Provide the legal name of your corporation along with any trade name or DBA, and select if you are claiming an overpayment.

- Fill in your mailing name and address, ensuring you note any changes in your address, and check the appropriate box if applicable.

- Complete the section detailing your state or country of incorporation and the date of incorporation. Provide your business telephone number for contact purposes.

- Indicate if your corporation has any subsidiaries incorporated outside of New York State, and respond to the MTA surcharge question regarding your business activities in the Metropolitan Commuter Transportation District.

- Carefully compute your entire net income base by filling out the relevant lines according to your income, deductions, and applicable additions. Make sure to refer to the instructions for assistance.

- Fill out the computation of capital base, ensuring to provide accurate average values and totals for your assets and liabilities.

- Complete the computation of minimum taxable income base, making sure to follow the instructions for depreciation and other adjustments.

- Calculate your tax based on the computed net income and capital base. Carefully review your tax credits and adjustments before finalizing your payment calculations.

- Review all sections for accuracy, download the completed form, and save any changes. Ensure you print or share the form as necessary before submission.

Start filling out your NY DTF CT-3 form online now for a smooth tax filing experience.

Corporate tax filing requirements. All New York C corporations subject to tax under Tax Law Article 9-A must file using the following returns, as applicable: Form CT-3, General Business Corporation Franchise Tax Return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.