Loading

Get Ct Cert-133 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT CERT-133 online

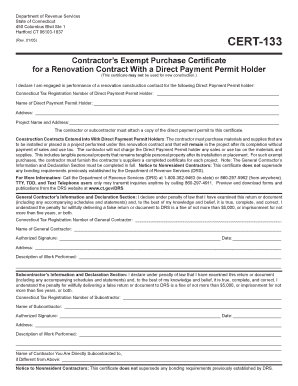

The CT CERT-133 form is a contractor's exempt purchase certificate specifically designed for renovation contracts involving direct payment permit holders in Connecticut. This guide provides a comprehensive overview and step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to complete the CT CERT-133 form.

- Click the ‘Get Form’ button to access the CT CERT-133 and open it in your online editing platform.

- In the first section, provide the Connecticut tax registration number of the direct payment permit holder in the designated field. This number is essential for validating the exemption claim.

- Enter the full name of the direct payment permit holder in the corresponding field. Ensure that the name is spelled accurately to avoid processing issues.

- Input the complete address of the direct payment permit holder. This includes the street address, city, state, and zip code.

- Provide the project name and address in the specified fields. Make sure to include detailed information about where the renovation work will occur.

- Attach a copy of the direct payment permit to this certificate. This is a necessary requirement for all submissions.

- Complete the general contractor’s information and declaration section with the contractor's Connecticut tax registration number, name, and authorized signature along with the date.

- In the description of work performed field, provide a clear and concise overview of the renovation work being executed.

- If applicable, fill out the subcontractor’s information and declaration, including their Connecticut tax registration number, name, authorized signature, and date.

- Finally, review all entries for accuracy. Upon ensuring all information is correct, save changes, and proceed to download, print, or share the completed form as needed.

Complete your documents online with ease today.

Related links form

General Purpose: A qualifying exempt organization must issue this certificate to retailers when purchasing items to be used by the organization exclusively for the purposes for which it was established.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.