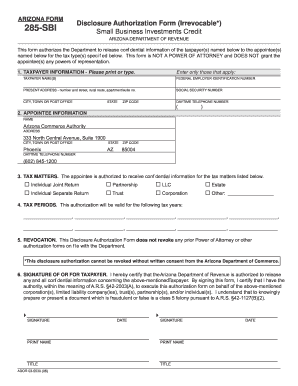

Get Az Dor 285b 2006

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign AZ DoR 285B online

How to fill out and sign AZ DoR 285B online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If the tax period commenced unexpectedly or perhaps you simply overlooked it, it might likely lead to issues for you. AZ DoR 285B is not the easiest form, but there is no need for alarm in any case.

Utilizing our user-friendly online software, you will discover the most effective method to complete AZ DoR 285B when facing tight time constraints. All you need to do is follow these simple guidelines:

By utilizing our robust digital solution and its expert tools, completing AZ DoR 285B becomes more manageable. Don’t hesitate to try it and spend more time on hobbies and interests rather than on document preparation.

Access the document using our advanced PDF editor.

Input the necessary details in AZ DoR 285B, utilizing fillable fields.

Include images, check marks, tick boxes, and text fields, if desired.

Repeated information will be populated automatically after the initial entry.

If you encounter any obstacles, activate the Wizard Tool. You will receive tips for easier completion.

Always remember to insert the application date.

Create your unique electronic signature once and place it in all required fields.

Review the information you entered. Rectify any errors if needed.

Click Done to complete modifications and select your delivery method. You will have the option to use virtual fax, USPS, or email.

You may also download the document for later printing or upload it to cloud storage such as Google Drive, OneDrive, etc.

How to modify Get AZ DoR 285B 2006: personalize forms online

Experience a hassle-free and digital method of modifying Get AZ DoR 285B 2006. Utilize our dependable online service and conserve considerable time.

Creating every document, including Get AZ DoR 285B 2006, from the ground up demands excessive effort, so utilizing a proven platform with pre-prepared document templates can greatly enhance your productivity.

However, adjusting them can pose a challenge, particularly for files in PDF format. Fortunately, our extensive collection features an integrated editor that allows you to swiftly finalize and modify Get AZ DoR 285B 2006 without needing to exit our site, preventing you from wasting hours altering your documents. Here's what you can achieve with your file using our service:

Whether you need to fill out editable Get AZ DoR 285B 2006 or any other document offered in our collection, you’re on the right path with our online document editor. It's simple and secure and doesn’t necessitate special expertise. Our web-based solution is designed to manage almost everything you can envisage regarding document editing and execution.

Ditch the obsolete methods of handling your forms. Embrace a professional solution to aid you in streamlining your duties and reducing reliance on paper.

- Step 1. Locate the necessary document on our site.

- Step 2. Click Get Form to access it in the editor.

- Step 3. Utilize our specialized editing tools that enable you to insert, delete, annotate, and emphasize or redact text.

- Step 4. Generate and incorporate a legally-binding signature into your document using the sign feature from the top toolbar.

- Step 5. If the document format doesn’t align with your needs, leverage the options on the right to eliminate, add, and reorganize pages.

- Step 6. Insert fillable fields so that others can be invited to complete the document (if needed).

- Step 7. Share or distribute the form, print it, or choose the format in which you’d like to receive the file.

Get form

Related links form

Mail your Arizona state tax forms to the address specified on the form or the Arizona Department of Revenue’s website. This ensures that your documents reach the correct department for processing. To avoid any hassles, double-check the mailing address for accuracy before sending your forms off.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.