Loading

Get Za Sars Travel Logbook 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA SARS Travel Logbook online

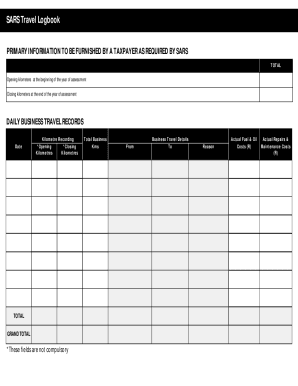

Filling out the ZA SARS Travel Logbook is essential for taxpayers who receive a travel allowance and wish to claim deductions for their business-related travel. This guide provides step-by-step instructions for completing the logbook online, ensuring that you accurately record your travel details.

Follow the steps to complete your travel logbook online.

- Click ‘Get Form’ button to access the ZA SARS Travel Logbook, making it available for you to fill out in an online format.

- Begin by entering the opening kilometers recorded at the beginning of the assessment year. Make sure to be precise, as this establishes your baseline for mileage.

- As you complete your travel for the year, record the closing kilometers at the end of the assessment year. This will allow you to calculate the total kilometers driven during the year.

- For each business trip, log the date of travel, the kilometers traveled, and the specific details of the trip, including the destination and reason for the travel. This information is crucial for verifying your business use.

- Document any actual fuel and oil costs incurred during your business travel. Similarly, record any repairs and maintenance costs linked to vehicle usage during the tax year.

- After entering all relevant data, review your logbook for accuracy. Ensure all mandatory fields are completed, even if certain fields, like opening and closing kilometer readings, are optional.

- Save any changes made to your logbook. Once satisfied, you can choose to download a copy, print it, or share it as needed to maintain your records.

Complete your ZA SARS Travel Logbook online today to ensure you maximize your possible deductions.

Related links form

Travel expenses are tax deductible only if incurred for the purpose of conducting business-related activities. The IRS considers employees to be traveling away from home if their business obligations require them to be away from their "tax home” substantially longer than an ordinary day's work.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.