Loading

Get Nj Ptr-1a 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ PTR-1A online

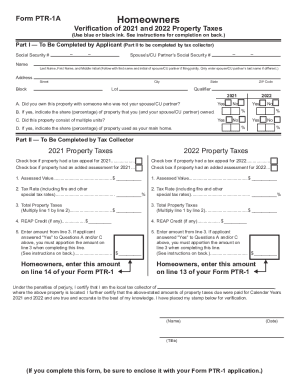

The NJ PTR-1A form is essential for verifying property taxes for homeowners seeking reimbursement. This guide provides clear, step-by-step instructions to assist you in accurately completing the form online.

Follow the steps to successfully fill out your NJ PTR-1A.

- Press the ‘Get Form’ button to access the NJ PTR-1A form and open it for editing.

- In Part I, provide your Social Security number. If you are married or in a civil union and are filing jointly, enter both applicants' Social Security numbers.

- Next, fill in your name and address, ensuring to include your spouse's or civil union partner's name if applicable.

- Enter the block and lot numbers of your principal residence along with any necessary qualifiers.

- Answer whether you own the property with someone who is not your spouse or partner by checking 'Yes' or 'No'.

- If applicable, indicate the percentage of ownership you and your spouse or partner have in the property.

- Answer if the property consists of multiple units and provide the percentage of the property used as your main home, if relevant.

- Once you’ve completed Part I, ensure all information is accurate before moving to Part II, which is to be filled out by the tax collector.

- Part II will involve entering assessed values, tax rates, and any credits for each applicable year as certified by the tax collector.

- Finally, complete the certification section at the bottom of the form, sign, and date it. You may then save changes, download, print, or share the completed form.

Complete your NJ PTR-1A online today to ensure a smooth filing process.

Specifically, the law (A1) will put an annual 50% credit directly on senior homeowners' property tax bills for their primary residences, initially capped at $6,500 — though it would be indexed, meaning it would go up if property taxes rise.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.