Loading

Get De Short Form Certificate Of Dissolution 2003-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DE Short Form Certificate Of Dissolution online

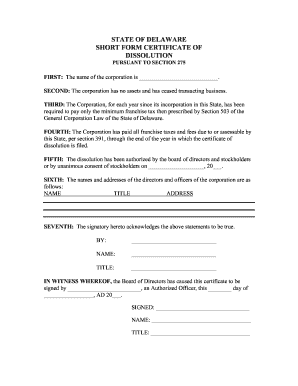

The DE Short Form Certificate Of Dissolution is a document used to formally dissolve a corporation in the state of Delaware. This guide provides clear and easy-to-follow steps on how to complete this form online, ensuring that users can efficiently navigate the process.

Follow the steps to complete the form successfully.

- Click the ‘Get Form’ button to obtain the DE Short Form Certificate Of Dissolution and open it in an accessible editor.

- In the first section, provide the name of the corporation exactly as it appears in official documents. Ensure this is accurate to avoid processing delays.

- In the second section, affirm that the corporation has no remaining assets and has ceased transacting business. This is an important declaration to confirm the corporation's status.

- For the third section, indicate that the corporation has only been required to pay the minimum franchise tax as per the General Corporation Law of Delaware. This is often the case for corporations that have not engaged in business activities.

- The fourth section requires confirmation that all franchise taxes and fees have been paid up to the year of filing the dissolution. This ensures compliance with state regulations.

- In the fifth section, specify the date when the dissolution was authorized by the board of directors and stockholders, or the date of unanimous consent from stockholders. Accurate dating is essential.

- In the sixth section, list the names, titles, and addresses of the directors and officers of the corporation. This information should be current and complete.

- The seventh section requires the signatory's acknowledgment that all statements are true. An authorized officer must sign the document.

- Lastly, ensure the certificate is signed by an Authorized Officer, along with their name and title, on the specified date. This finalizes the document.

- After completing the form, users can save changes, download, print, or share the completed DE Short Form Certificate Of Dissolution as needed.

Start filing your DE Short Form Certificate Of Dissolution online to complete your corporation's dissolution process.

Take a Member Vote. If the LLC Operating Agreement does not specify guidelines for canceling the LLC, the Delaware LLC Act states that the LLC may be canceled after affirmative or written consent of members who own more than two-thirds of the current percentage ownership.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.