Loading

Get Mn Hr Simplified Flexible Spending Account Claim Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN HR Simplified Flexible Spending Account Claim Form online

Filling out the MN HR Simplified Flexible Spending Account Claim Form online can be straightforward with the right guidance. This guide will provide you with clear steps and information to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the claim form.

- Click ‘Get Form’ button to access the form and open it in the editor.

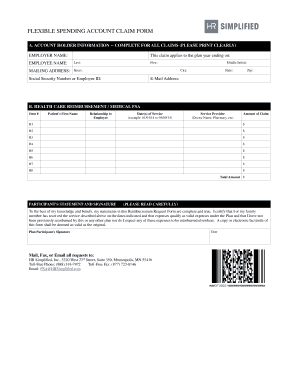

- Begin with section A, Account Holder Information. Fill in the employer name and the plan year ending on. Provide the employee's full name, mailing address including street, city, state, and zip code. Don’t forget to include their Social Security Number or Employee ID and email address.

- Proceed to section B, Health Care Reimbursement / Medical FSA. You will list each item for which you are seeking reimbursement. For each entry, include the item number, patient's first name, their relationship to the employee, the dates of service formatted as mm/dd/yy, the service provider's name, and the amount of the claim.

- Continue filling out the remaining item lines (H1 to H8), if applicable, ensuring all necessary information is recorded. At the end of this section, calculate and enter the total amount being claimed.

- Finally, review the Participant's Statement and provide your signature. This confirms your understanding that the information provided is complete and accurate, acknowledging that the expenses qualify under the plan.

- Once you have completed the form, you can save your changes, download, print, or share the form as needed. Make sure to submit your claim by mail, fax, or email to the specified HR Simplified contact details.

Start filling out your MN HR Simplified Flexible Spending Account Claim Form online today!

Related links form

What is a Flexible Spending Account (FSA)? A Flexible Spending Account (FSA) is a tax-favored program offered by employers that allow their employees to pay for eligible out-of-pocket medical, vision, and dental expenses and dependent care expenses with pre-tax dollars.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.