Loading

Get Ca Ftb 3815 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 3815 online

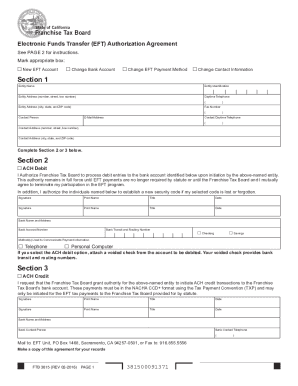

The CA FTB 3815 form is essential for those looking to authorize electronic funds transfer with the Franchise Tax Board in California. This guide will provide you with clear and concise steps to successfully complete the form online.

Follow the steps to fill out the CA FTB 3815 online.

- Press the ‘Get Form’ button to download the CA FTB 3815 form and open it for editing.

- Begin by completing Section 1, which requires you to fill out the entity name, identification, address, and contact details. Ensure that all blocks are filled clearly and accurately.

- In Section 2 or Section 3, select whether you are authorizing an ACH Debit or ACH Credit method for electronic funds transfer. Only complete one section based on your selection—do not fill both.

- If you selected ACH Debit, provide details of your bank, including the bank name and address, and your bank account information. Remember to include a voided check if required, which contains essential bank transit and routing numbers.

- If you selected ACH Credit, specify the bank contact information and ensure you understand that payments must follow the proper NACHA formats.

- Add your signatures, printed names, titles, and the date in both sections where applicable. This confirms your authorization for the selected transactions.

- After completing all necessary sections, save changes to the document, then print or share the completed CA FTB 3815. Make sure to retain a copy for your records.

Complete your CA FTB 3815 online for electronic funds transfer today.

To complete an EFT payment, the sender needs to provide a couple of key pieces of information, including the type of account receiving the funds, the name of the recipient's bank, the recipient's account number, the recipient's routing number.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.