Loading

Get Mm It-1i 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MM IT-1I online

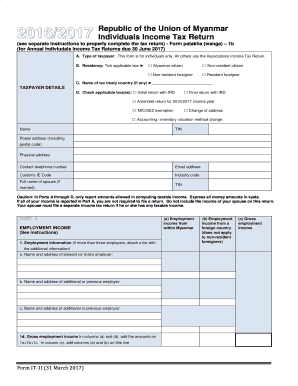

The MM IT-1I is the Individuals Income Tax Return form for the 2016/2017 tax year in Myanmar. This guide provides clear, step-by-step instructions to help you fill out the form accurately and efficiently online, ensuring compliance with tax regulations.

Follow the steps to complete your MM IT-1I form online.

- Press the ‘Get Form’ button to obtain the MM IT-1I form and open it in the editor.

- Begin with the Type of taxpayer section. Here, select the applicable box to indicate your taxpayer status: Myanmar citizen, non-resident citizen, non-resident foreigner, or resident foreigner.

- In the Residency section, tick the box corresponding to your residency status. Provide the name of a tax treaty country if applicable.

- Fill in the Taxpayer Details section. Check any applicable boxes, like initial return or final return, and provide your name, TIN, postal address, contact information, and details about your spouse if married.

- Proceed to Part A, where you will provide details about your employment income. List your current and previous employers' names and addresses and your Gross employment income.

- In Part B, report your business income and expenses. Enter your principal business or profession, total business income, and any relevant expenses, ensuring to attach the necessary schedules.

- Continue to Part C for Other income and expenses. Provide details about any other income and associated expenses, calculating your net income where necessary.

- In Part D, list any qualifying dependents you maintain. Make sure to include all necessary details as outlined in the instructions.

- Complete Part E by calculating your taxable income. Follow the instructions to enter net income and any carryover losses, along with special deductions.

- In Part F, compute your tax based on the taxable income calculated in Part E. Follow instructions to determine total taxes due and payments made.

- Finally, review all information entered to ensure accuracy. Once confirmed, you can save changes, download, print, or share your completed form.

Start filling out your MM IT-1I form online today to ensure timely and accurate tax reporting.

MM (Million) Definition. MM is the symbol used for representing the numbers in millions, whereas the symbol m is used as thousand in roman numbers and so mm is thousand multiplied by thousand, which is equal to 1 million.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.