Loading

Get Or 250-041 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 250-041 online

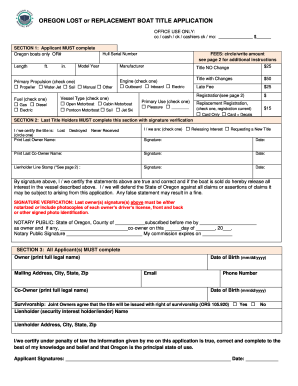

The OR 250-041 is an essential form for individuals seeking to apply for a lost or replacement boat title in Oregon. This user-friendly guide will walk you through the process of completing the form online with clear instructions for each section.

Follow the steps to complete the OR 250-041 form online

- Click the ‘Get Form’ button to obtain the form and open it in your browser. This action will allow you to access the OR 250-041 online for filling out.

- In Section 1, provide your information as the applicant. Enter the Oregon registration number, the length of the boat in feet, model year, and select the type of primary propulsion (propeller, water jet, sail, manual, or other) along with the fuel type (gas, diesel, or electric). Fill in the manufacturer's name and hull serial number. Additionally, select the vessel type (open motorboat, cabin motorboat, pontoon motorboat, sail, or jet ski) and the primary use of the boat.

- In Section 2, if you are the last title holder, you must complete this section. Circle the reason for the title request (lost, destroyed, never received), then print the last owner's name and check if you are releasing interest or requesting a new title. Include signatures and dates for both owners, if applicable.

- In Section 3, all applicants must fill in their full legal name, mailing address, date of birth, email, and phone number. If there is a co-owner, include their information as well. Specify if the title will be issued with right of survivorship by selecting yes or no.

- After completing all sections, carefully review the form for accuracy. If required, attach any necessary documentation such as identification or notarized signatures. Save your changes, download the filled form, or prepare it for printing.

Complete your OR 250-041 application online today for a seamless experience.

If your LLC has no income, you typically still need to file a tax return, even if it reports zero income. This ensures compliance with IRS regulations and maintains your LLC’s good standing. You can file a Form 1065 for multi-member LLCs or a Schedule C for single-member LLCs. Utilizing platforms like uslegalforms can simplify the process of filing and help you maintain compliance under OR 250-041.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.