Loading

Get Fannie Mae/freddie Mac Form 710 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae/Freddie Mac Form 710 online

The Fannie Mae/Freddie Mac Form 710 is an essential document for individuals experiencing mortgage payment challenges. This guide provides clear, step-by-step instructions for completing the form online, ensuring you have the support you need during this process.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the Fannie Mae/Freddie Mac Form 710 and open it in your preferred editor.

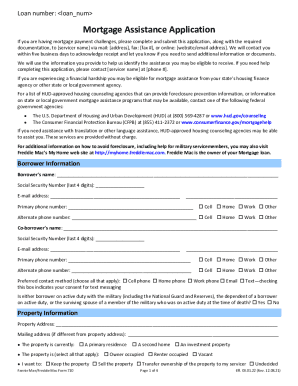

- Begin filling out the borrower information section. Enter the borrower's name, the last four digits of their Social Security number, email address, and primary phone number. Indicate the preferred contact method by checking the appropriate boxes.

- Complete the property information section by providing the property address and whether it is a primary residence, second home, or investment property. Check the appropriate boxes to indicate the occupancy status of the property.

- In the hardship information section, specify when the hardship began and categorize it as short-term or long-term. Check all applicable hardship types and provide any required documentation as specified.

- Fill out the borrower income section by entering the monthly income amounts for each type. Attach the necessary documentation showing income amounts, as specified in the form.

- List current borrower assets excluding retirement funds. Enter the amounts for checking accounts, savings, stocks, and any other assets.

- Review the borrower certification and agreement, ensuring that all information is accurate and truthful. Sign the form, along with the co-borrower, if applicable.

- Once completed, save the changes made to the form. You can then download, print, or share the completed form as needed.

Complete your Fannie Mae/Freddie Mac Form 710 online to access mortgage assistance today.

If it meets legal requirements for validity, the deed of trust has no automatic expiration. It will be valid until either the borrower repays the loan the trust deed is security for or if the property is sold in a foreclosure action.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.